Introduction

Investing in government-backed saving schemes is one of the safest ways to grow your wealth while ensuring financial security. These schemes offer guaranteed returns, tax benefits, and minimal risk, making them ideal for conservative investors. Whether you are planning for retirement, children’s education, or long-term wealth accumulation, these schemes provide stability and reliability.

In this blog, we will explore the best government-backed saving schemes, their benefits, interest rates, eligibility criteria, and how they compare to other investment options.

Why Choose Government-Backed Saving Schemes?

Government saving schemes are popular due to their low risk, attractive returns, and tax benefits. Here are some reasons why they are a preferred investment choice:

✅ Safety & Security – Backed by the government, reducing investment risks. ✅ Guaranteed Returns – Fixed interest rates ensure predictable earnings. ✅ Tax Benefits – Many schemes offer deductions under Section 80C of the Income Tax Act. ✅ Diverse Options – Suitable for different financial goals, from short-term savings to retirement planning. ✅ Easy Accessibility – Available through banks and post offices across the country.

Top Government-Backed Saving Schemes

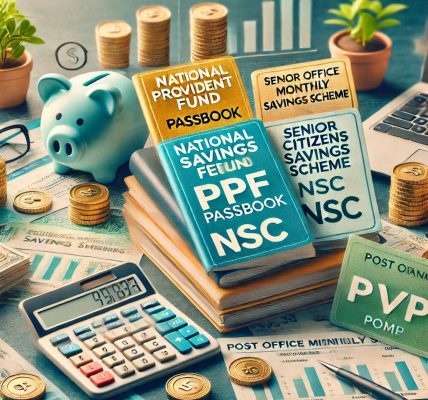

1. Public Provident Fund (PPF)

The PPF is a long-term investment scheme offering tax-free returns. It is best suited for individuals looking for retirement savings and wealth accumulation over time.

- Interest Rate: ~7.1% (compounded annually, subject to government revisions)

- Tenure: 15 years (can be extended in 5-year blocks)

- Tax Benefits: Tax exemption under Section 80C; interest earned is also tax-free

- Investment Limit: Minimum ₹500, Maximum ₹1.5 lakh per year

- Withdrawal Rules: Partial withdrawal allowed after 6 years

Best for: Long-term investors, retirement planning

2. National Savings Certificate (NSC)

The NSC is a fixed-income investment scheme that provides stable returns and is ideal for low-risk investors.

- Interest Rate: ~7.7% (compounded annually, but paid at maturity)

- Tenure: 5 years

- Tax Benefits: Eligible for deduction under Section 80C

- Investment Limit: No maximum limit, minimum ₹1,000

- Withdrawal Rules: Cannot be withdrawn before maturity

Best for: Safe investment with tax benefits, medium-term financial goals

3. Sukanya Samriddhi Yojana (SSY)

This scheme is designed for parents who want to secure their daughter’s future.

- Interest Rate: ~8% (compounded annually)

- Tenure: 21 years or until the girl turns 18 and gets married

- Tax Benefits: Tax-free interest and Section 80C deduction

- Investment Limit: Minimum ₹250, Maximum ₹1.5 lakh per year

- Withdrawal Rules: Partial withdrawal allowed after 18 years

Best for: Parents saving for their daughter’s education and marriage

4. Senior Citizens Savings Scheme (SCSS)

The SCSS is a risk-free investment option for individuals aged 60 and above, offering regular income.

- Interest Rate: ~8.2% (paid quarterly)

- Tenure: 5 years (extendable by 3 years)

- Tax Benefits: Eligible for deduction under Section 80C, but interest is taxable

- Investment Limit: Minimum ₹1,000, Maximum ₹30 lakh

- Withdrawal Rules: Premature withdrawal allowed with a penalty

Best for: Retirees seeking a stable income

5. Post Office Monthly Income Scheme (POMIS)

A secure investment providing monthly income, suitable for retirees and those looking for regular returns.

- Interest Rate: ~7.4% (paid monthly)

- Tenure: 5 years

- Tax Benefits: No Section 80C benefits; interest is taxable

- Investment Limit: Maximum ₹9 lakh (individual) or ₹15 lakh (joint account)

- Withdrawal Rules: Premature withdrawal allowed with a penalty

Best for: Regular income without risk

6. Kisan Vikas Patra (KVP)

A scheme aimed at doubling the investment amount within a fixed period.

- Interest Rate: ~7.5% (compounded annually)

- Tenure: ~115 months (subject to changes)

- Tax Benefits: No deductions; interest is taxable

- Investment Limit: Minimum ₹1,000; no upper limit

- Withdrawal Rules: Lock-in period of 2.5 years

Best for: Safe long-term wealth accumulation

7. Atal Pension Yojana (APY)

Designed for individuals in the unorganized sector, providing pension benefits post-retirement.

- Pension Amount: ₹1,000 to ₹5,000 per month (based on contribution)

- Eligibility: Age 18-40 years

- Government Contribution: Co-contribution for eligible subscribers

- Tax Benefits: Deductions under Section 80CCD

Best for: Retirement planning for low-income earners

8. Pradhan Mantri Vaya Vandana Yojana (PMVVY)

A pension scheme for senior citizens offering guaranteed returns.

- Interest Rate: ~7.4% (paid monthly)

- Tenure: 10 years

- Investment Limit: Up to ₹15 lakh

- Tax Benefits: Interest is taxable

Best for: Senior citizens needing pension security

Comparison of Government Saving Schemes

| Scheme | Interest Rate | Tenure | Tax Benefits | Suitable For |

|---|---|---|---|---|

| PPF | ~7.1% | 15 years | 80C + tax-free interest | Long-term savings, retirement |

| NSC | ~7.7% | 5 years | 80C benefits | Safe, medium-term savings |

| SSY | ~8% | Until girl turns 18/21 | 80C + tax-free interest | Daughter’s education/marriage |

| SCSS | ~8.2% | 5 years | 80C (interest taxable) | Senior citizens |

| POMIS | ~7.4% | 5 years | No tax benefits | Regular monthly income |

| KVP | ~7.5% | ~115 months | No tax benefits | Long-term wealth accumulation |

| APY | Pension-based | Lifetime | 80CCD benefits | Retirement for low-income earners |

| PMVVY | ~7.4% | 10 years | No tax benefits | Pension for senior citizens |

Conclusion

Government-backed saving schemes provide a safe, reliable, and tax-efficient way to build wealth. Choosing the right scheme depends on your financial goals, risk appetite, and investment horizon.

- For retirement savings, PPF, SCSS, APY, and PMVVY are ideal.

- For children’s future, Sukanya Samriddhi Yojana is the best.

- For stable monthly income, POMIS and SCSS work well.

- For safe long-term growth, NSC and KVP are strong options.

Evaluate your financial needs and invest in the scheme that aligns best with your future plans! 🚀