Introduction

Bonds are a preferred investment option for individuals looking for stable returns and low risk. However, an important factor often overlooked by investors is liquidity—the ability to sell a bond quickly without significantly impacting its price.

Liquidity can affect how quickly an investor can convert their bond holdings into cash and whether they get a fair price in the market. This comprehensive guide explores the concept of bond liquidity, the factors that affect it, and strategies to improve liquidity when managing a bond portfolio.

🎯 What Is Bond Liquidity?

Bond liquidity refers to how easily a bond can be bought or sold in the secondary market without causing a significant price change.

✅ Highly Liquid Bonds: Can be sold quickly at or near the current market price.

🚫 Illiquid Bonds: Difficult to sell quickly and may require accepting a lower price to attract buyers.

The liquidity of a bond affects its pricing, transaction costs, and the ease of exiting a position.

📊 Why Bond Liquidity Matters for Investors

✅ 1. Ability to Exit Positions Quickly

Highly liquid bonds allow investors to sell quickly during emergencies or to rebalance portfolios.

✅ 2. Minimal Price Impact

Liquid bonds can be sold without a significant drop in price, ensuring fair value realization.

✅ 3. Lower Transaction Costs

Bonds with high liquidity typically have narrower bid-ask spreads, reducing trading costs.

✅ 4. Flexibility in Changing Market Conditions

Liquid bonds offer the flexibility to adapt to changing market trends or investment goals.

📈 Factors Affecting Bond Liquidity

🏢 1. Bond Type and Issuer

The type of bond and the reputation of the issuer play a crucial role in determining its liquidity.

✅ Highly Liquid Bonds:

- Government bonds (e.g., U.S. Treasury bonds)

- Investment-grade corporate bonds

- Municipal bonds from highly rated issuers

🚫 Less Liquid Bonds:

- High-yield (junk) bonds

- Bonds from small or unknown issuers

- Structured or complex bond instruments

💹 2. Market Conditions and Economic Climate

Bond liquidity can fluctuate based on the prevailing market conditions.

✅ High Liquidity During Stable Markets:

Investors are more willing to trade bonds when the economy is stable.

🚫 Low Liquidity During Economic Uncertainty:

Market volatility and financial crises can reduce trading activity, making it harder to sell bonds.

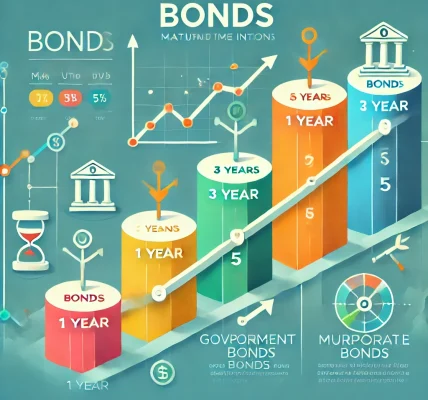

🕒 3. Time to Maturity

Liquidity is often influenced by the bond’s time to maturity.

✅ Highly Liquid Bonds:

- Short-term bonds that mature in 1-3 years

- Actively traded bonds with consistent demand

🚫 Less Liquid Bonds:

- Long-term bonds with maturities exceeding 10 years

- Bonds nearing maturity that have lost investor interest

📑 4. Credit Rating and Default Risk

Bonds with high credit ratings enjoy better liquidity as they are perceived as safer investments.

✅ High Liquidity for Investment-Grade Bonds:

Bonds rated AAA, AA, A, or BBB by rating agencies like Moody’s and S&P.

🚫 Low Liquidity for Junk Bonds:

High-yield bonds rated BB or below have higher default risks and lower demand.

💸 5. Trading Volume and Secondary Market Activity

Bonds that are frequently traded in the secondary market tend to be more liquid.

✅ High Liquidity for Actively Traded Bonds:

- U.S. Treasury bonds

- Popular corporate bonds

🚫 Low Liquidity for Thinly Traded Bonds:

- Niche or customized bond offerings

- Bonds held by institutional investors with long-term commitments

🔥 6. Bid-Ask Spread

The bid-ask spread—the difference between the price a buyer is willing to pay and the price a seller wants—affects liquidity.

✅ Narrow Spread: Indicates high liquidity and ease of trading.

🚫 Wide Spread: Suggests illiquidity and higher transaction costs.

🔍 7. Issuer Reputation and Market Perception

Investors prefer bonds issued by reputable institutions, making them easier to sell.

✅ Highly Liquid Bonds: Issued by trusted governments or blue-chip corporations.

🚫 Less Liquid Bonds: From unknown or risky issuers with limited credibility.

💡 How to Assess Bond Liquidity Before Investing

✅ 1. Analyze Trading Volume

Check the bond’s average daily trading volume to assess its market activity.

Tip: Higher trading volume suggests a more liquid bond.

✅ 2. Review Bid-Ask Spreads

Narrow bid-ask spreads indicate better liquidity and lower transaction costs.

Tip: Compare spreads with similar bonds to gauge liquidity.

✅ 3. Check Credit Ratings and Risk Profiles

Investment-grade bonds with high credit ratings are generally easier to sell.

Tip: Monitor any credit rating changes that might affect liquidity.

✅ 4. Evaluate Maturity and Market Demand

Consider the bond’s maturity and the level of demand in the secondary market.

Tip: Short-term and actively traded bonds are typically more liquid.

🛡️ Strategies to Improve Liquidity of Your Bond Portfolio

📈 1. Diversify Across Bond Types

Holding a mix of government, corporate, and municipal bonds helps maintain liquidity in different market conditions.

✅ Action Plan: Allocate investments across bonds with different maturities and credit ratings.

🔄 2. Invest in Actively Traded Bonds

Focus on bonds that are traded frequently in the secondary market.

✅ Action Plan: Choose bonds with high trading volume and stable demand.

⏰ 3. Opt for Short-to-Medium Maturity Bonds

Short-term bonds are typically easier to sell and experience less price volatility.

✅ Action Plan: Balance your portfolio with bonds that mature within 1-5 years.

📊 4. Monitor Market Conditions Regularly

Stay informed about market trends that may impact bond liquidity.

✅ Action Plan: Review economic indicators, interest rate movements, and bond yield trends.

🛑 5. Avoid Low-Quality or High-Risk Bonds

High-yield bonds and bonds from less credible issuers are harder to sell in the secondary market.

✅ Action Plan: Prioritize bonds with higher credit ratings and strong financial backing.

🎉 Conclusion: Navigating Bond Liquidity for Smart Investing

Liquidity is a critical factor in determining the success of bond investments. Understanding the factors that affect bond liquidity and taking proactive steps to improve it can help investors mitigate risks and achieve their financial goals.

✅ Key Takeaways:

- Assess bond liquidity by analyzing trading volume, bid-ask spreads, and credit ratings.

- Diversify bond holdings to reduce liquidity risk.

- Stay informed about market trends that may impact the ease of selling bonds.

By incorporating these strategies, investors can build a bond portfolio that is both profitable and resilient in changing market conditions.