Introduction

In the world of investing, bond allocation plays a critical role in balancing risk and returns. Bonds are a preferred asset class for conservative investors seeking stability, but allocating bonds effectively can be complex. By understanding different types of bonds and implementing a diversified allocation strategy, investors can reduce risks while optimizing returns. This blog will explore how to allocate bonds strategically, taking into account factors such as risk tolerance, market conditions, and investment goals.

🎯 What Is Bond Allocation?

Bond allocation refers to the proportion of bonds included in an investment portfolio. It involves selecting various types of bonds (government, corporate, high-yield, etc.) and determining their appropriate weight based on the investor’s risk appetite and financial objectives. Proper bond allocation ensures a balance between income stability and capital preservation while mitigating potential market volatility.

📊 Why Strategic Bond Allocation Matters?

Strategic bond allocation is essential because:

✅ Reduces Portfolio Volatility: Bonds provide stability and act as a buffer against stock market downturns.

✅ Preserves Capital: Government and high-quality bonds safeguard your principal during uncertain market conditions.

✅ Generates Consistent Income: Fixed-income bonds provide regular interest payments, which are ideal for retirees.

✅ Balances Risk and Reward: By diversifying across different types of bonds, investors can mitigate specific risks while maintaining a steady income.

🧩 Key Factors to Consider in Bond Allocation

1. 🎯 Risk Tolerance

Your risk appetite dictates the types of bonds to include in your portfolio.

- Low-Risk Investors: Focus on government bonds, treasury securities, and investment-grade corporate bonds.

- Moderate-Risk Investors: Combine corporate bonds with government bonds for balanced returns.

- High-Risk Investors: Include high-yield (junk) bonds or emerging market bonds to seek higher returns.

2. 📈 Investment Horizon

The time frame for your investment affects the bond allocation strategy.

- Short-Term Goals (1-5 Years): Favor short-duration bonds to minimize interest rate risks.

- Medium-Term Goals (5-10 Years): Opt for a balanced mix of government and corporate bonds.

- Long-Term Goals (10+ Years): Diversify with long-term bonds and inflation-protected securities (TIPS).

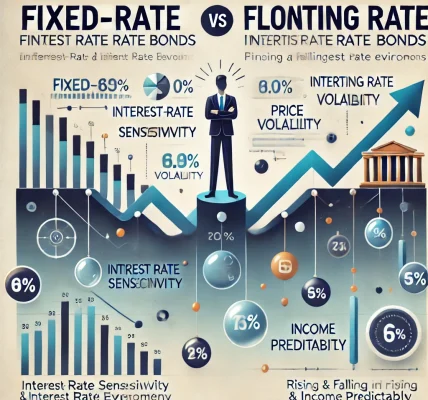

3. 📊 Interest Rate Environment

Interest rate changes impact bond prices.

- Rising Rates: Invest in short-duration and floating-rate bonds to mitigate price declines.

- Falling Rates: Opt for long-duration bonds to capitalize on price appreciation.

4. 🛡️ Credit Quality

Assess the credit ratings of bonds to manage credit risk.

- AAA-Rated Bonds: Safer but lower returns.

- BBB and Below: Higher yields but increased default risk.

🔥 Types of Bonds for Diversification

A diversified bond portfolio includes different types of bonds to spread risk and enhance returns.

1. 🏦 Government Bonds (Low Risk, Low Returns)

- Issued by governments and considered the safest.

- Examples: U.S. Treasury Bonds, Indian Government Bonds, and UK Gilts.

- Suitable for conservative investors.

2. 🏢 Corporate Bonds (Moderate Risk, Moderate Returns)

- Issued by companies to fund their operations.

- Higher returns than government bonds but involve credit risk.

- Ideal for income-seeking investors.

3. 🌱 Municipal Bonds (Tax-Advantaged)

- Issued by local governments with tax benefits.

- Suitable for high-income investors seeking tax-free returns.

4. 📈 High-Yield Bonds (High Risk, High Returns)

- Also known as junk bonds, they offer higher yields but have higher default risk.

- Suitable for aggressive investors seeking maximum returns.

5. 🌍 Emerging Market Bonds (High Growth Potential)

- Issued by developing countries, offering higher yields but with added geopolitical risks.

- Suitable for risk-tolerant investors looking to diversify geographically.

📚 Strategic Bond Allocation Models

📊 1. Conservative Allocation (80% Bonds, 20% Stocks)

- Suitable for retirees and risk-averse investors.

- Emphasizes safety and income generation.

- Ideal Bond Mix: 60% government bonds, 20% corporate bonds.

📊 2. Moderate Allocation (60% Bonds, 40% Stocks)

- Ideal for balanced investors who seek a mix of growth and security.

- Mitigates downside risk while capturing market gains.

- Ideal Bond Mix: 40% government bonds, 20% corporate bonds.

📊 3. Aggressive Allocation (40% Bonds, 60% Stocks)

- Suitable for young investors with a higher risk appetite.

- Seeks higher long-term growth by balancing bonds with equities.

- Ideal Bond Mix: 20% government bonds, 20% high-yield bonds.

🚨 Common Bond Allocation Mistakes to Avoid

- Overweighting Low-Yield Bonds: Reduces long-term growth potential.

- Ignoring Credit Risk: High-yield bonds may offer better returns but increase default risk.

- Neglecting Duration Risk: Long-duration bonds are sensitive to interest rate fluctuations.

- Lack of Diversification: A bond portfolio that focuses on one category increases vulnerability to market shifts.

📈 How to Rebalance Your Bond Portfolio

Regularly rebalancing your bond portfolio is essential to maintain your desired asset allocation.

✅ Annual Reviews: Assess portfolio performance and rebalance if the allocation drifts significantly.

✅ Adjust for Market Conditions: Shift bond types based on changing interest rates.

✅ Diversify Constantly: Add new bond instruments to spread risk effectively.

📝 Legal Considerations for Bond Allocation

To ensure compliance and avoid legal risks:

✅ Disclose Investment Risks: Always inform investors of potential bond risks.

✅ Regulatory Compliance: Follow guidelines issued by regulatory authorities (e.g., SEBI in India or SEC in the U.S.).

✅ Avoid Misrepresentation: Provide accurate information on bond features and risks.

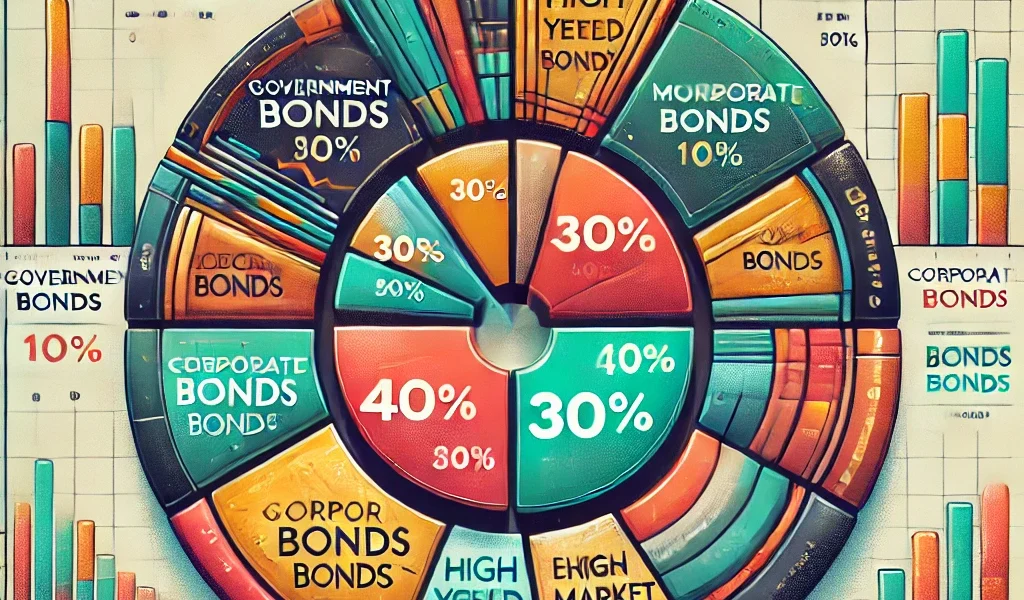

📊 Example of a Diversified Bond Allocation Portfolio

| Bond Type | Allocation (%) | Risk Level |

|---|---|---|

| Government Bonds | 40% | Low |

| Corporate Bonds | 30% | Moderate |

| Municipal Bonds | 10% | Low |

| High-Yield Bonds | 10% | High |

| Emerging Market Bonds | 10% | High |

🎉 Conclusion: Build a Balanced Bond Portfolio for Long-Term Success

Strategic bond allocation is the key to maintaining a balance between risk and returns. By diversifying across bond types, regularly rebalancing, and understanding market conditions, investors can achieve financial stability and steady income growth. Whether you are a conservative, moderate, or aggressive investor, a well-planned bond allocation strategy helps you secure your financial future.