Introduction

Diversification is a crucial strategy for managing investment risks and optimizing returns. Mutual funds provide an excellent avenue for diversification as they allow investors to spread their money across various asset classes, sectors, and geographical regions. This guide will help you understand how to diversify your portfolio using mutual funds effectively while ensuring compliance with financial regulations and best practices.

Understanding Diversification in Mutual Funds

Diversification is the process of allocating investments across different financial instruments, industries, and other categories to reduce risk. Mutual funds inherently offer diversification, but investors can further optimize their portfolios by choosing the right mix of funds.

Benefits of Diversification with Mutual Funds

- Risk Mitigation: Reduces the impact of market fluctuations by spreading investments across multiple assets.

- Stable Returns: Helps balance gains and losses, leading to more stable overall portfolio performance.

- Capital Protection: Minimizes the risk of capital loss from poor-performing assets.

- Exposure to Growth Opportunities: Provides access to different sectors and geographies with high growth potential.

Key Strategies to Diversify Using Mutual Funds

1. Diversify Across Asset Classes

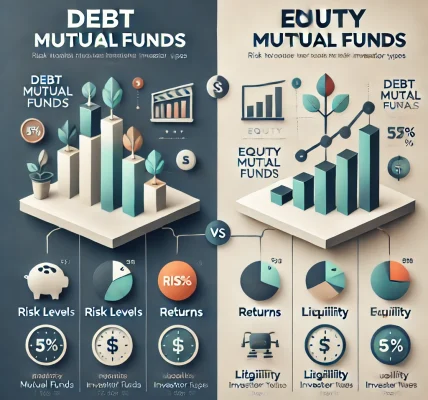

- Equity Mutual Funds: Invest in stocks and offer high growth potential but come with higher risk.

- Debt Mutual Funds: Invest in fixed-income securities, providing stable returns with lower risk.

- Hybrid/Balanced Funds: Combine equity and debt investments for a balanced approach.

- Gold and Commodity Funds: Help hedge against inflation and currency fluctuations.

- Real Estate Investment Trusts (REITs) Funds: Provide exposure to the real estate sector without direct ownership.

2. Diversify Within Equity Funds

- Large-Cap Funds: Invest in well-established companies with stable returns.

- Mid-Cap Funds: Offer higher growth potential but with increased volatility.

- Small-Cap Funds: High risk but high reward, suitable for aggressive investors.

- Sectoral/Thematic Funds: Focus on specific sectors like technology, healthcare, or energy.

- International Funds: Provide exposure to global markets and reduce country-specific risks.

3. Diversify Within Debt Funds

- Short-Term Debt Funds: Suitable for investors seeking liquidity and stability.

- Long-Term Debt Funds: Provide higher returns for those with a longer investment horizon.

- Corporate Bond Funds: Invest in corporate bonds offering relatively higher yields.

- Government Securities (G-Secs) Funds: Offer safety with moderate returns.

4. Diversify Geographically

Investing in international mutual funds reduces reliance on a single economy and provides exposure to global opportunities. Examples include:

- US-based Funds: Exposure to top-performing US companies.

- Emerging Market Funds: Invest in fast-growing economies like China, India, and Brazil.

- Europe and Asia-Pacific Funds: Provide diversification across developed and developing markets.

5. Diversify Investment Strategies

- Active Funds: Managed by professional fund managers who make investment decisions based on research.

- Passive Funds (Index Funds & ETFs): Track a specific index and have lower expense ratios.

- Systematic Investment Plan (SIP): Allows disciplined investing in mutual funds at regular intervals.

- Lump Sum Investment: Suitable for those with a higher risk appetite and lump sum capital.

Factors to Consider When Diversifying

- Investment Goals: Define short-term, medium-term, and long-term objectives.

- Risk Tolerance: Assess how much risk you are willing to take.

- Time Horizon: Align fund selection with your investment duration.

- Expense Ratios and Fees: Lower fees enhance overall returns.

- Fund Performance and Ratings: Analyze historical returns and fund manager expertise.

- Tax Efficiency: Consider tax-saving mutual funds like ELSS (Equity Linked Savings Scheme).

Common Mistakes to Avoid in Diversification

- Over-Diversification: Investing in too many funds can dilute returns and make tracking difficult.

- Ignoring Risk Appetite: Choosing funds that do not align with your risk profile can lead to financial stress.

- Frequent Portfolio Changes: Constantly switching funds may result in losses due to exit loads and tax implications.

- Chasing Past Performance: A fund’s past performance is not always indicative of future results.

- Neglecting Portfolio Review: Regular reviews help rebalance and optimize your investments.

Conclusion

Diversification using mutual funds is a smart way to manage risk and optimize returns. By carefully selecting a mix of asset classes, sectors, geographies, and investment strategies, investors can build a well-balanced portfolio that aligns with their financial goals. Regular monitoring and strategic rebalancing will ensure sustained growth and financial security. Always consult a financial advisor for personalized investment advice tailored to your needs.