Investing in mutual funds is a proven way to create long-term wealth, provided you select the right funds that align with your financial goals and risk tolerance. This blog explores some of the best mutual funds for long-term wealth creation, considering performance, risk factors, and investment objectives.

Why Choose Mutual Funds for Long-Term Investment?

Mutual funds offer diversification, professional management, and compounding benefits, making them ideal for long-term investments. Here are some key reasons why investors prefer mutual funds:

- Diversification: Reduces risk by investing in multiple securities.

- Professional Management: Fund managers handle portfolio allocation and stock selection.

- Compounding Growth: Reinvesting earnings over time leads to exponential wealth accumulation.

- Flexibility: Various fund categories cater to different risk appetites and investment horizons.

Types of Mutual Funds for Long-Term Wealth Creation

To build long-term wealth, selecting the right type of mutual fund is crucial. Below are some of the best categories:

1. Equity Mutual Funds

Equity mutual funds primarily invest in stocks and have the potential for higher returns over a long period. Ideal for investors with high-risk tolerance.

- Large-Cap Funds: Invest in well-established companies with stable growth.

- Mid-Cap and Small-Cap Funds: Higher growth potential but with greater volatility.

- Multi-Cap Funds: Diversify investments across different market capitalizations.

2. Index Funds

Index funds passively track market indices like the S&P 500, Nifty 50, or Sensex. They offer lower expense ratios and reduce the risk of poor fund management decisions.

- Low-cost investment option

- Long-term consistency with market performance

- Ideal for passive investors

3. ELSS (Equity Linked Savings Scheme)

ELSS funds offer tax benefits under Section 80C of the Income Tax Act while investing in equity markets.

- Lock-in period of 3 years

- High return potential compared to traditional tax-saving instruments

- Best for investors seeking tax efficiency and wealth creation

4. Hybrid Funds (Balanced Funds)

These funds invest in a mix of equity and debt instruments to balance risk and reward.

- Equity-Oriented Hybrid Funds: Best for growth-focused investors with moderate risk tolerance.

- Debt-Oriented Hybrid Funds: More stable returns with lower equity exposure.

5. Debt Mutual Funds (For Conservative Investors)

Debt funds are ideal for investors who prefer lower risk and steady income. These funds invest in bonds, treasury bills, and other fixed-income securities.

- Corporate Bond Funds

- Government Securities (Gilt) Funds

- Short-Term and Long-Term Bond Funds

Top Performing Mutual Funds for Long-Term Wealth Creation

1. Best Large-Cap Equity Funds

- ICICI Prudential Bluechip Fund

- HDFC Top 100 Fund

- SBI Bluechip Fund

2. Best Mid & Small-Cap Equity Funds

- Axis Midcap Fund

- Kotak Small Cap Fund

- DSP Midcap Fund

3. Best Index Funds

- UTI Nifty 50 Index Fund

- HDFC Index Fund – Sensex Plan

- ICICI Prudential Nifty Next 50 Index Fund

4. Best Hybrid Funds

- SBI Equity Hybrid Fund

- HDFC Balanced Advantage Fund

- ICICI Prudential Multi-Asset Fund

5. Best Debt Funds

- SBI Magnum Medium Duration Fund

- HDFC Corporate Bond Fund

- ICICI Prudential Gilt Fund

Factors to Consider Before Investing

1. Investment Horizon

- Long-term investments should ideally be 5+ years to benefit from market fluctuations and compounding.

2. Risk Appetite

- Equity funds suit aggressive investors, while debt funds are better for conservative investors.

3. Expense Ratio

- Choose funds with lower expense ratios to maximize returns.

4. Fund Performance History

- Analyze past performance but also consider consistency and fund management strategies.

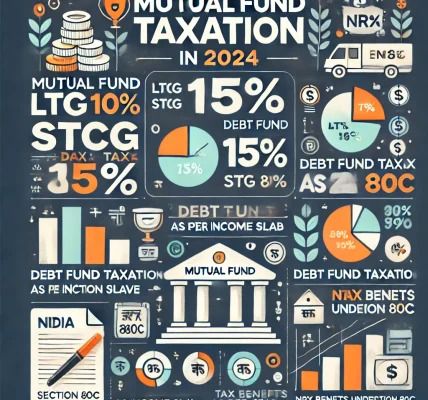

5. Tax Efficiency

- Equity funds are more tax-efficient compared to debt funds.

- Long-term capital gains (LTCG) on equity funds above INR 1 lakh attract a 10% tax.

Conclusion

Mutual funds provide an excellent avenue for long-term wealth creation. By choosing the right funds based on your financial goals, risk tolerance, and investment horizon, you can maximize returns and achieve financial freedom. Whether you opt for equity, hybrid, index, or debt funds, a disciplined approach to investing will help you build substantial wealth over time.