Introduction

Saving money is an essential part of financial security and independence. A well-planned savings strategy ensures that you have funds for emergencies, major life events, retirement, and future investments. However, simply setting aside money is not enough—you need a structured approach to make the most of your savings. This guide will help you create a smart savings strategy tailored to your financial goals.

Step 1: Define Your Savings Goals

The first step in creating a smart savings strategy is to identify why you are saving. Your goals could include:

- Emergency Fund: Covering 3-6 months of expenses in case of job loss or unforeseen expenses.

- Short-Term Goals: Buying a car, vacation, wedding, or home renovation.

- Medium-Term Goals: Saving for a down payment on a house or children’s education.

- Long-Term Goals: Retirement planning and wealth accumulation.

Once you have clear goals, assign a time frame and target amount to each one.

Step 2: Create a Budget and Identify Savings Potential

A budget helps track your income, expenses, and potential savings. Follow these steps:

- Calculate Your Income: Include salary, freelance earnings, rental income, and any other sources.

- List Essential Expenses: Rent, groceries, utilities, transportation, insurance, and debt payments.

- Identify Discretionary Expenses: Entertainment, dining out, subscriptions, and luxury purchases.

- Determine Your Savings Capacity: Dedicate a percentage of your income to savings before spending on non-essentials.

A commonly used rule is the 50/30/20 Rule:

- 50% on Needs (housing, utilities, food, insurance, debt payments)

- 30% on Wants (entertainment, shopping, travel)

- 20% on Savings & Investments (emergency fund, retirement, wealth building)

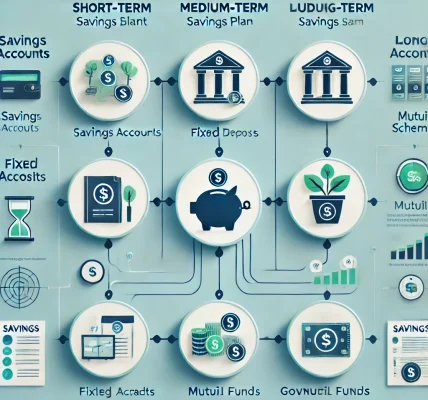

Step 3: Choose the Right Savings Accounts & Investment Plans

To make the most of your savings, you should choose the right financial tools:

- Emergency Fund: Keep it in a High-Interest Savings Account (HISA) for easy access and security.

- Short-Term Goals: Use Fixed Deposits (FDs), Recurring Deposits (RDs), or liquid mutual funds.

- Medium-Term Goals: Consider Public Provident Fund (PPF), National Savings Certificate (NSC), or balanced mutual funds.

- Long-Term Goals: Invest in retirement accounts, stocks, real estate, and index funds.

Step 4: Automate Your Savings

To ensure consistency, set up automatic transfers from your salary account to your savings and investment accounts. This “pay yourself first” approach ensures you save before you spend.

Step 5: Reduce Unnecessary Expenses

Cutting down on non-essential expenses can significantly boost your savings. Strategies include:

- Cooking at home instead of eating out.

- Canceling unused subscriptions.

- Using public transportation instead of a car for short distances.

- Comparing prices before making large purchases.

Step 6: Diversify Your Savings and Investments

A smart savings strategy includes diversification to minimize risk and maximize returns. Instead of relying on just one savings vehicle, use a mix of:

- Savings accounts for liquidity.

- Fixed deposits for stability.

- Mutual funds for growth.

- Retirement accounts for long-term security.

Step 7: Regularly Review and Adjust Your Plan

Your financial situation and goals may change over time, so it’s important to review your savings strategy at least once a year. Check if you’re on track, increase your savings percentage when possible, and adjust investments based on market conditions and personal milestones.

Conclusion

Creating a smart savings strategy requires planning, discipline, and the right financial tools. By setting clear goals, budgeting wisely, automating savings, and diversifying investments, you can secure your financial future and achieve your dreams. Start today and build a foundation for long-term financial success!