Introduction

Managing personal finances can be overwhelming, especially with multiple expenses, financial goals, and unexpected emergencies. Many people struggle to balance their income between needs, wants, and savings. The 50/30/20 rule offers a simple and effective framework for budgeting that can help you achieve financial stability while allowing flexibility in spending.

In this guide, we’ll break down the 50/30/20 rule, explain its benefits, and provide actionable tips on how to implement it in your daily life.

What is the 50/30/20 Rule?

The 50/30/20 budgeting rule is a straightforward financial strategy that divides your after-tax income into three categories:

- 50% for Needs – Essential expenses required for survival.

- 30% for Wants – Lifestyle choices and discretionary spending.

- 20% for Savings and Debt Repayment – Future financial security.

This method ensures a balanced approach to financial planning, allowing you to cover necessary expenses while still enjoying life and securing your future.

Breaking Down the 50/30/20 Rule

50% – Essentials (Needs)

This category covers all necessary expenses that you cannot avoid. These are things required for survival and basic living standards.

Examples of Needs:

- Rent or mortgage payments

- Utility bills (electricity, water, internet, phone, etc.)

- Groceries and essential food items

- Insurance (health, home, auto, life)

- Transportation (gas, public transit, car loan payments)

- Minimum debt repayments (credit card, student loans)

💡 Tip: If your necessary expenses exceed 50% of your income, consider adjusting your lifestyle, such as choosing a more affordable living arrangement or reducing utility costs.

30% – Lifestyle (Wants)

The next 30% is allocated to personal and lifestyle choices. These are non-essential expenses that enhance your quality of life but are not mandatory for survival.

Examples of Wants:

- Dining out and entertainment

- Shopping (clothing, gadgets, accessories)

- Gym memberships

- Travel and vacations

- Streaming services (Netflix, Spotify, etc.)

- Hobbies and leisure activities

💡 Tip: While it’s important to enjoy life, be mindful of unnecessary spending. Prioritize experiences and purchases that bring long-term happiness rather than impulsive buys.

20% – Savings and Debt Repayment

The final 20% of your income should be dedicated to building financial security and reducing debt. This category helps prepare for future financial goals and unforeseen emergencies.

Examples of Savings and Investments:

- Emergency fund (3-6 months of living expenses)

- Retirement savings (401(k), IRA, mutual funds)

- Investments (stocks, real estate, ETFs)

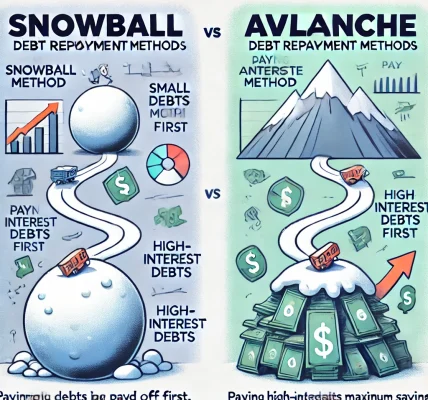

- Debt repayment (extra payments on credit cards, loans, mortgages)

- Education savings (college funds, courses for skill development)

💡 Tip: Automate savings and debt payments to ensure consistency and discipline in achieving financial goals.

How to Implement the 50/30/20 Rule in Your Life

Step 1: Calculate Your After-Tax Income

Start by determining your monthly after-tax income (net income). This is the amount left after taxes, social security, and deductions.

For example:

- Salary before tax: $5,000

- Taxes & deductions: $1,000

- After-tax income: $4,000

Your budget will be based on this final amount.

Step 2: Allocate Your Income According to the 50/30/20 Rule

Once you know your after-tax income, divide it into the three categories:

- Needs (50%): $2,000 (rent, food, insurance, bills)

- Wants (30%): $1,200 (entertainment, hobbies, shopping)

- Savings & Debt Repayment (20%): $800 (investments, savings, extra debt payments)

Adjust the numbers based on your specific situation.

Step 3: Track Your Expenses

Monitor your spending using budgeting apps, spreadsheets, or notebooks to ensure you stay within limits.

Some useful budgeting tools include:

- Mint – Automatically tracks expenses and categorizes them.

- YNAB (You Need A Budget) – Helps you assign every dollar a purpose.

- Personal Capital – Great for tracking investments and net worth.

Step 4: Adjust and Optimize Your Budget

If you find that your essential expenses exceed 50% or your lifestyle spending is too high, make necessary adjustments:

- Reduce housing costs (move to a more affordable home or refinance loans).

- Cut down on dining out and entertainment.

- Eliminate or negotiate unnecessary subscriptions.

- Find ways to increase your income (side hustles, freelancing, investments).

Benefits of the 50/30/20 Rule

✔ Simplicity – Easy to understand and implement. ✔ Flexibility – Can be adjusted to suit different income levels and financial goals. ✔ Balance – Ensures essential needs are covered while allowing room for enjoyment and future security. ✔ Long-Term Financial Health – Encourages saving and debt reduction, leading to financial stability. ✔ Prevention of Overspending – Helps in making mindful financial decisions.

Common Mistakes to Avoid

❌ Misclassifying Needs and Wants – Some people categorize luxury items as essentials. ❌ Not Tracking Spending – Without monitoring, it’s easy to exceed the allocated budget. ❌ Ignoring Debt Repayments – Prioritizing wants over debt reduction can lead to financial trouble. ❌ Not Adjusting for Income Changes – Your budget should evolve with income increases or unexpected financial situations.

Conclusion

The 50/30/20 rule is an effective, beginner-friendly budgeting method that promotes financial discipline while allowing flexibility. By allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment, you can build a secure financial future while still enjoying life.

Start implementing this strategy today, track your expenses, and make adjustments as needed. With consistency, you’ll gain financial confidence and work towards long-term success.