Introduction

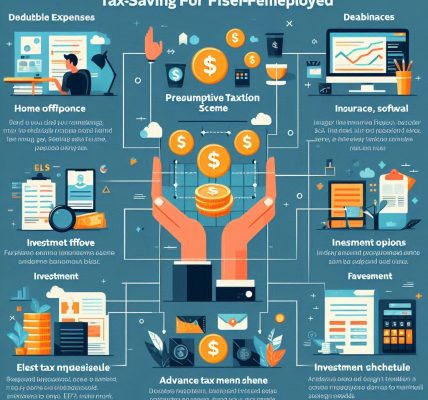

Tax planning is an essential part of financial management. With the right investment choices, you can maximize tax deductions while also growing your wealth. The Indian Income Tax Act provides several avenues to legally reduce taxable income through deductions, exemptions, and rebates.

In this guide, we will explore the best investment options that help you save taxes while ensuring compliance with all legal norms.

1. Section 80C: The Most Popular Tax-Saving Investments

Under Section 80C, individuals can claim deductions up to ₹1.5 lakh per financial year by investing in certain financial instruments. Some of the most effective investment options under this section include:

a) Employees’ Provident Fund (EPF)

- Mandatory for salaried employees

- Employer and employee both contribute 12% of basic salary + DA

- Interest earned and maturity amount are tax-free under the Exempt-Exempt-Exempt (EEE) rule

b) Public Provident Fund (PPF)

- Ideal for risk-averse investors

- Interest rate is revised quarterly by the government

- Lock-in period of 15 years (partial withdrawal after 7 years)

- Tax-free interest and maturity amount

c) Equity-Linked Savings Scheme (ELSS)

- A mutual fund scheme with a lock-in period of 3 years

- Offers the potential for high returns compared to other tax-saving instruments

- Investments up to ₹1.5 lakh qualify for deductions under Section 80C

- Long-Term Capital Gains (LTCG) over ₹1 lakh taxed at 10%

d) National Savings Certificate (NSC)

- Fixed-income investment backed by the government

- Interest is compounded annually and reinvested

- Suitable for risk-averse investors

e) Sukanya Samriddhi Yojana (SSY)

- Specially designed for a girl child’s education and marriage

- Lock-in until the girl reaches 21 years

- Higher interest rate compared to PPF

f) Tax-Saving Fixed Deposits (FDs)

- 5-year lock-in period

- Interest earned is taxable

- Suitable for those looking for secure returns

2. Section 80D: Health Insurance Premiums

Investing in health insurance not only secures your financial future but also provides tax benefits:

- ₹25,000 deduction for self, spouse, and children

- ₹50,000 deduction for senior citizens (above 60 years)

- An additional ₹50,000 for parents’ health insurance (if senior citizens)

3. Section 80E: Education Loan Interest Deduction

- Tax benefits on interest paid on education loans for higher studies

- No upper limit on deductions

- Loan can be taken for self, spouse, children, or legal guardian

- Available for a maximum of 8 years from the year of repayment commencement

4. Section 24(b): Home Loan Interest Deduction

- Deduction up to ₹2 lakh per financial year on home loan interest

- If the property is rented out, full interest paid can be deducted

- Additional deduction of ₹50,000 under Section 80EE for first-time home buyers

5. National Pension System (NPS) – Section 80CCD(1) & 80CCD(1B)

- Deduction up to ₹1.5 lakh under Section 80CCD(1) (part of 80C limit)

- Additional deduction of ₹50,000 under Section 80CCD(1B) beyond 80C limit

- Helps in retirement planning with a mix of equity and debt investment

6. Section 80G: Donations to Charitable Organizations

- Contributions to eligible charitable institutions and relief funds qualify for tax deduction

- Some donations qualify for 100% deduction (e.g., Prime Minister’s Relief Fund)

- Others qualify for 50% deduction with or without an upper limit

7. Rajiv Gandhi Equity Savings Scheme (RGESS) – Section 80CCG

- Available to first-time retail investors

- Deduction of 50% of investment amount (up to ₹50,000) for three consecutive years

- Investments must be made in approved equities

8. Agriculture Income Tax Exemption

- Income earned from agricultural activities is fully tax-free under Section 10(1)

- Includes income from growing crops, rental income from agricultural land, etc.

9. Section 80TTA & 80TTB: Interest on Savings Account

- Section 80TTA: Deduction of up to ₹10,000 on savings account interest (for individuals & HUFs)

- Section 80TTB: Deduction of up to ₹50,000 for senior citizens

10. Capital Gains Tax Exemptions

Investments in certain assets provide capital gains exemptions:

- Section 54: Exemption on capital gains from the sale of residential property if reinvested in another house

- Section 54EC: Exemption if gains from selling property are invested in specified bonds (REC, NHAI, etc.) within 6 months

- Section 54F: Exemption on long-term capital gains from selling any asset if reinvested in a house property

Conclusion

Investing wisely not only helps in wealth creation but also provides significant tax benefits. By strategically utilizing Section 80C, 80D, 80E, 24(b), NPS, and capital gains exemptions, taxpayers can optimize their tax liability while ensuring financial security.