Managing debt can be overwhelming, but having a structured repayment strategy can help you regain financial control and achieve financial freedom. Two of the most popular methods for debt repayment are the Snowball Method and the Avalanche Method. Both approaches have their advantages, but choosing the right one depends on your financial situation and psychological preference. In this guide, we will break down both strategies and help you determine which one is best suited for you.

Understanding the Importance of Debt Repayment

Carrying excessive debt can lead to financial stress, impact your credit score, and limit future financial opportunities. Paying off debt effectively can help you:

- Improve your financial stability.

- Increase your creditworthiness.

- Reduce overall interest payments.

- Achieve financial freedom faster.

Choosing a structured repayment plan is crucial for success, and that’s where the Snowball and Avalanche methods come in.

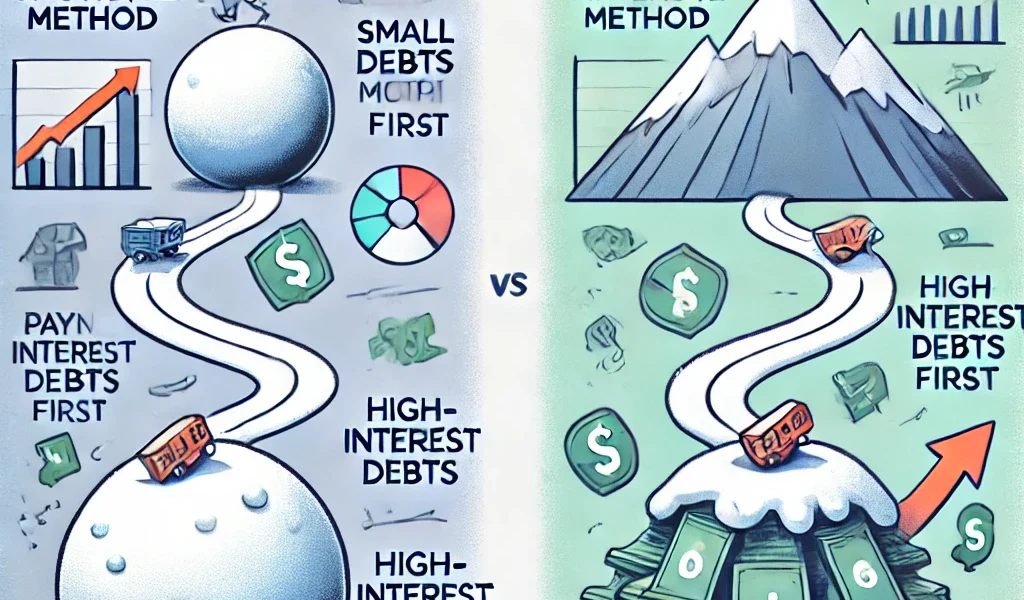

What Is the Snowball Method?

The Snowball Method, popularized by financial expert Dave Ramsey, focuses on building momentum by paying off debts from smallest to largest, regardless of interest rates.

How the Snowball Method Works:

- List all your debts from the smallest balance to the largest.

- Make minimum payments on all debts except the smallest one.

- Allocate any extra money towards paying off the smallest debt first.

- Once the smallest debt is fully paid, roll over that payment amount to the next smallest debt.

- Repeat this process until all debts are paid off.

Pros of the Snowball Method:

- Psychological Motivation – Paying off smaller debts quickly gives a sense of accomplishment, keeping you motivated.

- Simple and Easy to Follow – The method is straightforward and provides quick wins.

- Effective for Those Who Need Encouragement – Helps people who need small victories to stay committed.

Cons of the Snowball Method:

- Not Interest-Efficient – You might end up paying more in interest over time since it doesn’t focus on high-interest debts first.

- Slower Financial Savings – If your largest debt has a high interest rate, you may spend more money in the long run.

What Is the Avalanche Method?

The Avalanche Method prioritizes paying off debts with the highest interest rates first, saving you money on interest payments in the long run.

How the Avalanche Method Works:

- List all your debts from highest to lowest interest rate.

- Make minimum payments on all debts except the one with the highest interest rate.

- Allocate extra money towards paying off the highest-interest debt first.

- Once that debt is paid off, roll over that payment amount to the next highest interest debt.

- Repeat until all debts are cleared.

Pros of the Avalanche Method:

- Saves Money on Interest – Since high-interest debts are eliminated first, you pay less interest overall.

- Faster Debt Payoff – Mathematically, it’s the most efficient way to get out of debt.

- Best for People Focused on Savings – Ideal for those who prioritize financial efficiency over motivation.

Cons of the Avalanche Method:

- Requires Discipline – Results take longer to see, which can be discouraging for some.

- Lack of Immediate Wins – Since high-interest debts tend to be larger, it might take longer to pay off your first debt.

- Can Feel Overwhelming – Requires a long-term commitment, which may be difficult for those who need quick motivation.

Snowball vs. Avalanche: Which One Should You Choose?

When to Choose the Snowball Method:

- You need quick wins to stay motivated.

- Your smaller debts are easy to clear fast.

- You struggle with financial discipline and need a structured, encouraging system.

When to Choose the Avalanche Method:

- You want to save the most money in interest.

- You can stay disciplined without needing quick wins.

- You have large, high-interest debts that are financially draining.

Alternative Debt Repayment Strategies

If neither method seems ideal, you can also explore:

- Debt Consolidation – Combining multiple debts into a single loan with a lower interest rate.

- Balance Transfer Credit Cards – Transferring high-interest credit card debt to a card with a 0% intro APR.

- Debt Settlement – Negotiating with creditors to reduce the total amount owed (may impact your credit score negatively).

Final Thoughts

Choosing between the Snowball Method and Avalanche Method depends on your personal financial situation and psychological approach to debt repayment. If you need motivation and enjoy small victories, the Snowball Method may be best. If you prioritize financial savings and efficiency, the Avalanche Method will work better for you.

Regardless of the method you choose, the key to successful debt repayment is consistency and commitment. Take control of your financial future by selecting a strategy that works for you and sticking with it until you achi