Introduction

Market volatility is an inevitable part of investing. Whether driven by economic factors, geopolitical events, or investor sentiment, volatility can significantly impact mutual fund investments. Understanding how market fluctuations affect your portfolio is crucial for making informed decisions and ensuring long-term investment success.

In this article, we will explore the causes of market volatility, its effects on mutual funds, and strategies to manage risks while maximizing returns.

What is Market Volatility?

Market volatility refers to the rapid and unpredictable movement of asset prices within financial markets. It is measured using indicators such as the Volatility Index (VIX), which tracks expected market fluctuations.

Causes of Market Volatility:

- Economic Events – Interest rate changes, inflation, and GDP growth impact investor confidence.

- Political and Geopolitical Events – Elections, wars, or global trade tensions create uncertainty.

- Company Performance – Earnings reports, acquisitions, or scandals can influence stock prices.

- Market Speculation – Large-scale buying or selling based on speculation can cause sharp price swings.

- Global Market Trends – Economic downturns or booms in international markets often influence local markets.

How Market Volatility Affects Mutual Funds

Since mutual funds consist of multiple assets (stocks, bonds, etc.), their performance is closely tied to market conditions. Volatility impacts different types of mutual funds in various ways:

1. Equity Mutual Funds

- Stocks are highly sensitive to market fluctuations.

- High volatility can lead to short-term losses but may create opportunities for long-term gains.

- Growth-oriented funds tend to be more volatile than dividend-focused funds.

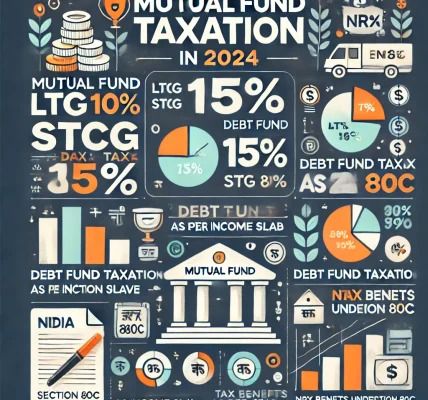

2. Debt Mutual Funds

- Market volatility affects bond prices, particularly due to interest rate changes.

- Rising interest rates generally cause bond prices to decline, impacting debt funds negatively.

- Short-duration debt funds are less sensitive to market fluctuations than long-duration funds.

3. Hybrid Funds

- These funds invest in both equities and debt instruments.

- Market downturns may affect the equity portion, while the debt component can provide stability.

- Proper asset allocation within hybrid funds can help mitigate risks.

4. Index Funds & ETFs

- These passively managed funds mirror the market index and react directly to market fluctuations.

- Investors need a long-term perspective to ride out market swings.

Strategies to Manage Market Volatility in Mutual Fund Investments

1. Diversification: Don’t Put All Your Eggs in One Basket

- Invest across asset classes (equities, debt, gold, etc.) to reduce risk.

- Diversification ensures that losses in one asset class may be balanced by gains in another.

2. Systematic Investment Plan (SIP): Invest Regularly

- Investing through SIPs helps in cost averaging during volatile periods.

- It reduces the impact of short-term market movements and provides better long-term returns.

3. Stay Invested for the Long Term

- Market volatility is more pronounced in the short term, but markets generally recover over time.

- Staying invested allows you to benefit from compounding and market rebounds.

4. Avoid Panic Selling

- Many investors exit the market during downturns out of fear.

- Selling at a loss locks in those losses, while staying invested increases chances of recovery.

5. Rebalance Your Portfolio Periodically

- Adjusting your investment allocation helps maintain desired risk levels.

- Rebalancing ensures you’re not overexposed to a particular asset class during volatility.

6. Focus on Fundamental Strength

- Invest in mutual funds with strong track records and experienced fund managers.

- Quality funds withstand market downturns better than speculative investments.

How Different Investors Should React to Market Volatility

1. Conservative Investors

- Focus on debt funds or hybrid funds to minimize risk.

- Prioritize funds with lower volatility and steady returns.

2. Moderate Investors

- Balance between equity and debt mutual funds.

- Choose blue-chip and large-cap funds for stability.

3. Aggressive Investors

- Can take advantage of volatility by investing in undervalued stocks.

- Continue investing in equity funds and high-growth sectors.

Historical Evidence: Market Recovery After Volatility

Market corrections and crashes have occurred multiple times, but history shows that markets tend to recover and grow over time.

Example:

- The 2008 Global Financial Crisis saw major stock market crashes, but markets recovered strongly over the next decade.

- The COVID-19 Market Crash (March 2020) resulted in sharp declines, but within a year, markets reached new highs.

This reinforces the importance of staying invested and avoiding panic-driven decisions during volatile times.

Conclusion: Should You Worry About Market Volatility?

Market volatility is a natural part of investing, but it should not deter you from mutual fund investments. Instead, understanding how volatility affects your portfolio can help you make better investment decisions.

Key Takeaways:

- Volatility is temporary, but long-term investments tend to grow.

- Diversification, SIPs, and rebalancing can reduce risk.

- Avoid emotional decisions like panic selling.

- Stick to quality funds and stay focused on long-term goals.