Introduction

Estate planning is a crucial aspect of financial management that ensures your wealth is effectively distributed to your heirs while minimizing taxes and preserving family assets. Among the various financial instruments available for estate planning, bonds play a unique and often underappreciated role. Bonds offer a reliable income stream, protection against market volatility, and can be strategically used to preserve and transfer wealth. This guide explores how bonds fit into estate planning and wealth preservation, their benefits, and practical strategies for incorporating them into your financial legacy.

Understanding Bonds in Estate Planning

Bonds are fixed-income securities where investors lend money to a government or corporation in exchange for periodic interest payments and the return of principal at maturity. In estate planning, bonds can serve as a stable, predictable asset class to balance risk, generate income, and ensure wealth preservation over time.

Types of Bonds Used in Estate Planning:

- Government Bonds: Issued by national governments (e.g., U.S. Treasury bonds) and considered low-risk, making them ideal for preserving wealth.

- Municipal Bonds: Issued by local governments, these often provide tax-free interest, which is advantageous for high-net-worth individuals.

- Corporate Bonds: Issued by companies, offering higher yields with varying risk levels.

- Savings Bonds: Ideal for smaller estates, offering secure, low-maintenance income.

- Inflation-Protected Bonds (TIPS): Safeguard against inflation by adjusting principal value over time.

Why Include Bonds in Estate Planning?

- Wealth Preservation: Bonds provide stability and predictable returns, protecting assets from market volatility.

- Income Generation: Regular coupon payments create a consistent cash flow for heirs or charitable donations.

- Tax Efficiency: Municipal bonds offer tax-free income, reducing the overall tax burden in an estate.

- Liquidity Management: Bonds with staggered maturities provide liquidity, helping heirs cover expenses without liquidating other assets.

- Diversification: Bonds diversify an estate portfolio, balancing risks associated with equities or real estate.

Strategic Uses of Bonds in Estate Planning

- Funding a Trust: Bonds can provide steady, low-risk returns for revocable or irrevocable trusts, ensuring beneficiaries receive reliable income without exposing the principal to significant market risk.

- Charitable Giving: Charitable Remainder Trusts (CRTs) funded with bonds offer income during the donor’s lifetime while leaving the remainder to charity, providing tax deductions and legacy preservation.

- Providing for Dependents: Bonds ensure a dependable income source for financially dependent heirs, such as minor children or disabled family members.

- Tax Minimization: Utilizing tax-free municipal bonds reduces estate and income tax liabilities.

- Wealth Transfer: Zero-coupon bonds, which mature at a higher value, can be gifted at a lower current valuation, reducing gift tax exposure.

Benefits of Using Bonds for Wealth Preservation

- Capital Protection: Bonds preserve capital, reducing the impact of market downturns on estate value.

- Predictable Cash Flow: Fixed interest payments ensure steady cash flow, aiding in legacy planning and future expenses.

- Lower Volatility: Bonds typically exhibit lower price volatility than stocks, safeguarding wealth during uncertain times.

- Estate Liquidity: Bond maturities can be planned to provide liquid cash for estate taxes, legal fees, and distribution.

Risks to Consider When Using Bonds in Estate Planning

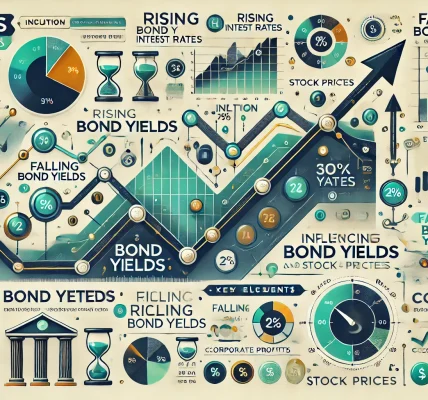

- Inflation Risk: Fixed-income bonds can lose purchasing power if inflation outpaces interest earnings.

- Credit Risk: Corporate and municipal bonds may carry the risk of issuer default.

- Interest Rate Risk: Rising interest rates can reduce the market value of existing bonds.

- Estate Tax Implications: Large bond holdings can increase the value of the estate and trigger estate taxes without proper planning.

Bond Ladder Strategy for Estate Planning

A bond ladder is an investment strategy where bonds with different maturity dates are held. This approach provides regular income while minimizing interest rate risk. For estate planning, it ensures:

- Continuous Liquidity: Provides cash flow for heirs and estate expenses.

- Risk Management: Diversifies exposure across various terms and issuers.

- Flexibility: Allows for reinvestment as bonds mature, adapting to changing needs.

Integrating Bonds with Other Estate Planning Tools

- Trusts and Bonds: Use bonds to fund living trusts, ensuring smooth asset transition and avoiding probate.

- Life Insurance and Bonds: Combine bonds with life insurance for liquidity to cover estate taxes and maintain asset value.

- Charitable Trusts: Fund charitable trusts with bonds for tax benefits and philanthropic goals.

- Gifting Bonds: Use annual gift tax exclusions to transfer bonds to heirs gradually, reducing the taxable estate.

Best Practices for Using Bonds in Estate Planning

- Diversify Bond Holdings: Include a mix of government, municipal, and corporate bonds to balance risk and reward.

- Plan for Inflation: Incorporate inflation-protected securities to maintain purchasing power.

- Consult Professionals: Engage with financial planners and estate attorneys to optimize bond strategies for your specific needs.

- Review Regularly: Periodically review and adjust bond holdings to align with evolving tax laws and family circumstances.

Conclusion

Bonds play a vital role in estate planning and wealth preservation by offering stability, income generation, and tax efficiency. By strategically incorporating bonds into your estate plan, you can safeguard your financial legacy while ensuring a smooth wealth transfer to future generations. Careful planning and professional guidance are essential to maximize the benefits and mitigate potential risks.

Always consult with a financial advisor and legal professional to ensure that bond strategies align with your estate planning objectives and comply with current regulations.