Investing in bonds can be a rewarding strategy for conservative investors, providing stable income and portfolio diversification. However, when interest rates rise, bond prices tend to fall, which can make bond investments seem less attractive. Understanding how to navigate a rising interest rate environment is crucial for bond investors to protect their investments and even capitalize on potential opportunities.

In this blog post, we will explore strategies for investing in bonds during a period of rising interest rates, so you can make informed decisions and manage your portfolio effectively.

Understanding the Impact of Rising Interest Rates on Bonds

To understand how rising interest rates affect bonds, let’s first review the basic relationship between bond prices and interest rates. When interest rates increase:

- Existing bond prices fall: This happens because newer bonds will offer higher interest rates (or coupon rates), making existing bonds with lower rates less attractive.

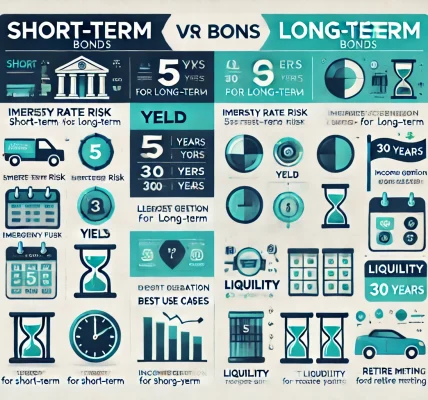

- Longer-duration bonds are more sensitive: Bonds with longer maturities tend to be more sensitive to interest rate changes. This means their prices will drop more significantly than those of short-term bonds.

- Yield curve steepening: In a rising interest rate environment, the yield curve can steepen, meaning the difference between short-term and long-term bond yields grows larger.

However, despite the negative impact on bond prices, there are ways to invest strategically in bonds even when interest rates are on the rise.

1. Consider Short-Term Bonds

One of the most straightforward strategies for managing interest rate risk is to focus on short-term bonds. Short-term bonds have maturities of 1-3 years and are less sensitive to interest rate changes. This is because they mature quickly and are less exposed to the long-term fluctuations of interest rates.

- Advantages: Short-term bonds are less volatile and provide more flexibility. As interest rates rise, you can reinvest your principal more quickly into higher-yielding bonds when the bonds mature.

- Example: Treasury bills or short-term corporate bonds are often ideal choices in this environment.

2. Look for Floating Rate Bonds

Another option to protect your investments from rising interest rates is floating rate bonds. Unlike fixed-rate bonds, floating-rate bonds have interest rates that adjust periodically based on a benchmark interest rate, such as LIBOR or SOFR (Secured Overnight Financing Rate).

- Advantages: The interest rate on these bonds rises with market rates, ensuring that you continue to receive competitive yields, even in a rising interest rate environment.

- Example: Floating rate notes (FRNs) are a common choice for those looking to hedge against rising rates.

3. Focus on High-Quality Bonds

In times of rising interest rates, focusing on high-quality bonds, such as investment-grade bonds or municipal bonds, can help mitigate risk. These bonds are less likely to default compared to lower-rated bonds, and they tend to be more stable during periods of market turbulence.

- Advantages: High-quality bonds typically offer lower yields than lower-rated bonds, but their reduced risk makes them a safer choice during periods of economic uncertainty or rising rates.

- Example: U.S. Treasury bonds, highly rated municipal bonds, and investment-grade corporate bonds are excellent options.

4. Avoid Long-Term Bonds

While long-term bonds (with maturities greater than 10 years) can offer attractive yields in a low-interest-rate environment, they are particularly vulnerable to rising interest rates. As rates rise, the price of long-term bonds tends to decline more sharply, which can lead to significant losses if you sell them before maturity.

- Strategy: If you hold long-term bonds, consider shifting to bonds with shorter durations. Alternatively, you can also consider bond laddering, which involves holding bonds with different maturities to spread out interest rate risk.

5. Bond Laddering Strategy

Bond laddering is a strategy where you invest in bonds with varying maturities, spreading your investment across short, medium, and long-term bonds. This allows you to:

- Take advantage of higher yields in longer-term bonds while limiting the impact of interest rate fluctuations.

- Reinvest proceeds from maturing bonds into higher-yielding bonds as rates rise.

For example, you could buy bonds with maturities of 2, 5, and 10 years. As the shorter-term bonds mature, you can reinvest the principal into bonds with higher yields, while the longer-term bonds continue to provide income.

- Advantages: Bond laddering helps provide a consistent income stream while reducing the risk of holding all your bonds to maturity in a rising rate environment.

6. Inflation-Protected Bonds

Rising interest rates are often a response to inflation concerns. In such cases, inflation-protected bonds, such as Treasury Inflation-Protected Securities (TIPS), can be an excellent hedge against rising rates and inflation.

- How it works: TIPS offer a fixed interest rate, but the principal value of the bond is adjusted for inflation. This means that as inflation rises, both the interest payments and the principal value of the bond increase.

- Advantages: TIPS can offer protection against the eroding effect of inflation, which often accompanies rising interest rates.

7. Stay Diversified

Even in a rising interest rate environment, it’s important to maintain a diversified bond portfolio. A mix of bond types (e.g., government bonds, corporate bonds, municipal bonds) and durations can help reduce the overall risk of your bond investments.

- Diversification: By holding a variety of bonds, you can smooth out the volatility caused by rising rates. This also allows you to take advantage of different bond sectors and maturities, giving you greater flexibility to adapt to changing market conditions.

8. Consider Bond Funds and ETFs

If you prefer a more hands-off approach to investing in bonds, you might want to consider bond mutual funds or exchange-traded funds (ETFs). These funds pool money from many investors to buy a diversified portfolio of bonds.

- Advantages: Bond funds and ETFs offer instant diversification and professional management. They can be a good option if you’re unsure about selecting individual bonds or want to avoid the complexity of managing a bond ladder yourself.

Conclusion

Investing in bonds during a rising interest rate environment requires a thoughtful approach to mitigate risks and capitalize on opportunities. By focusing on short-term bonds, floating-rate bonds, high-quality bonds, and diversifying your bond holdings, you can navigate the challenges of rising rates while protecting your portfolio.