Financial planning is the cornerstone of a secure and prosperous future. It helps individuals and families map out their short-term and long-term goals, ensuring financial stability and growth. Whether you dream of owning a home, starting a business, or retiring comfortably, a well-structured financial plan serves as a roadmap to achieving those ambitions. In this article, we will explore how financial planning supports life goals and why it is an essential part of personal and professional success.

1. Clarity in Financial Goals

Overview

A structured financial plan helps in identifying and setting clear financial objectives. Without a plan, managing income, savings, and investments can become chaotic, leading to unnecessary financial stress.

Benefits

✅ Provides a clear vision of future financial needs.

✅ Helps in prioritizing goals based on urgency and importance.

✅ Reduces financial uncertainty and allows for better decision-making.

How to Implement

- List down your short-term goals (vacations, buying gadgets, etc.) and long-term goals (home purchase, retirement, children’s education, etc.).

- Allocate funds accordingly to avoid financial burdens in the future.

- Regularly review and update goals as life circumstances change.

2. Efficient Budgeting and Expense Management

Overview

Budgeting ensures that you spend wisely and save consistently, helping you reach financial milestones faster.

Benefits

✅ Helps track income and expenses efficiently.

✅ Prevents unnecessary expenditures and promotes disciplined spending.

✅ Ensures savings and investments align with life goals.

How to Implement

- Use budgeting apps to monitor spending patterns.

- Follow the 50/30/20 rule (50% needs, 30% wants, 20% savings/investments).

- Adjust budget based on lifestyle changes and financial goals.

3. Building an Emergency Fund

Overview

Life is unpredictable, and unexpected expenses such as medical emergencies, job loss, or urgent repairs can disrupt financial stability. An emergency fund acts as a financial safety net.

Benefits

✅ Avoids reliance on loans or credit cards during emergencies.

✅ Provides financial security and peace of mind.

✅ Prevents disruption in long-term financial goals.

How to Implement

- Save at least 3-6 months’ worth of expenses in a liquid savings account.

- Keep the fund separate from regular savings to avoid unnecessary withdrawals.

- Replenish the fund whenever used.

4. Smart Investment Planning

Overview

Investing wisely helps in wealth creation and financial growth, ensuring that your money works for you.

Benefits

✅ Helps beat inflation and grow wealth over time.

✅ Provides financial security for retirement and future goals.

✅ Ensures financial independence.

How to Implement

- Diversify investments into stocks, bonds, mutual funds, real estate, and retirement accounts.

- Invest based on risk tolerance and financial objectives.

- Seek guidance from financial advisors for optimized investment planning.

5. Retirement Planning for a Comfortable Future

Overview

Retirement planning ensures financial independence post-retirement, allowing you to maintain your standard of living without financial stress.

Benefits

✅ Helps build a sufficient retirement corpus.

✅ Ensures financial independence in old age.

✅ Reduces dependency on others for financial support.

How to Implement

- Contribute regularly to retirement accounts like 401(k), IRA, or pension plans.

- Start early to take advantage of compounding interest.

- Review and adjust retirement savings based on lifestyle goals.

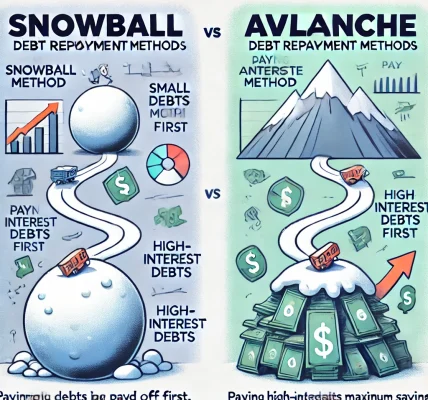

6. Debt Management for Financial Freedom

Overview

Debt, if not managed wisely, can become a significant financial burden. Effective financial planning helps in debt reduction and management.

Benefits

✅ Reduces financial stress and improves credit score.

✅ Frees up income for investments and savings.

✅ Prevents high-interest payments on loans and credit cards.

How to Implement

- Pay off high-interest debts first (credit cards, personal loans).

- Consolidate loans if needed for lower interest rates.

- Avoid unnecessary borrowing and live within means.

7. Tax Planning for Maximum Savings

Overview

Proper tax planning helps in reducing tax liabilities and increasing overall savings.

Benefits

✅ Helps in legally minimizing tax payments.

✅ Increases disposable income for financial goals.

✅ Ensures compliance with tax laws.

How to Implement

- Utilize tax-saving investments like retirement accounts, tax-free bonds, and deductions.

- Claim eligible tax credits and exemptions.

- Consult a tax professional for personalized tax strategies.

8. Securing Future with Insurance Planning

Overview

Insurance plays a crucial role in protecting financial stability against unexpected events.

Benefits

✅ Provides financial security to family members.

✅ Covers medical expenses, reducing out-of-pocket costs.

✅ Protects assets from unforeseen risks.

How to Implement

- Get life insurance to secure dependents.

- Opt for health insurance to cover medical emergencies.

- Consider disability and property insurance for additional coverage.

Final Thoughts

A well-structured financial plan helps individuals achieve their life goals by ensuring stability, growth, and security. From budgeting and investment planning to debt management and retirement savings, each component of financial planning plays a vital role in shaping a financially secure future.

Key Takeaways:

✅ Financial planning provides clarity and direction for achieving life goals.

✅ Budgeting and saving help in expense management and financial security.

✅ Investing wisely ensures wealth accumulation and financial independence.

✅ Retirement and tax planning minimize financial risks and optimize savings.

✅ Insurance planning protects against unexpected financial challenges.

By following these strategies, individuals can create a strong financial foundation and work toward a secure and prosperous future.

Disclaimer:

This article is for informational purposes only and does not constitute financial or legal advice. Please consult a certified financial advisor before making any financial decisions.