Introduction

Investing is one of the most effective ways to grow your wealth, but choosing the right investment vehicle can be challenging. Two of the most popular investment options are mutual funds and stocks. While both offer the potential for high returns, they differ significantly in terms of risk, management, and required expertise.

This guide will help you understand the differences between mutual funds and stocks, their advantages and disadvantages, and which one may be the right choice for you.

1. Understanding Mutual Funds and Stocks

What are Mutual Funds?

Mutual funds are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Managed by professional fund managers.

- Provides diversification, reducing the risk.

- Available in different types (Equity, Debt, Hybrid, etc.).

What are Stocks?

Stocks represent ownership in a company. When you buy a stock, you become a shareholder and own a portion of that company.

- Direct investment in individual companies.

- Returns depend on company performance.

- Higher potential returns but also higher risk.

2. Key Differences Between Mutual Funds and Stocks

| Feature | Mutual Funds | Stocks |

|---|---|---|

| Risk Level | Lower due to diversification | High, depends on individual stock performance |

| Management | Professionally managed | Self-managed |

| Investment Control | Limited control, as fund managers make decisions | Full control over stock selection |

| Returns | Moderate and stable | Potentially high but volatile |

| Time Required | Passive investment | Requires active monitoring |

| Diversification | High (invests in multiple assets) | Low (unless investor diversifies manually) |

| Liquidity | Can be redeemed anytime, but subject to exit loads | Highly liquid, can be sold instantly (except for market restrictions) |

| Taxation | Capital gains tax applicable based on holding period | Capital gains tax applicable based on holding period |

3. Pros and Cons of Mutual Funds and Stocks

Mutual Funds: Pros and Cons

✅ Advantages:

- Professional management reduces the need for individual expertise.

- Diversification minimizes risk.

- Ideal for long-term wealth creation.

- Suitable for beginner investors.

❌ Disadvantages:

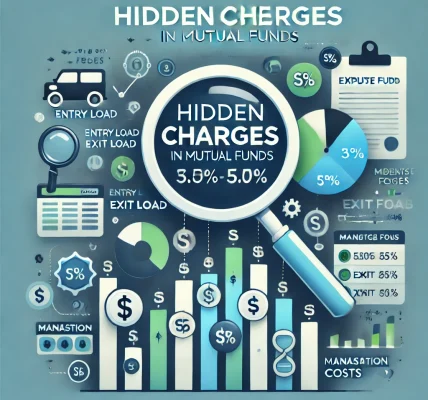

- Fund management fees and expense ratios reduce returns.

- Limited control over specific investments.

- May have exit loads and lock-in periods.

Stocks: Pros and Cons

✅ Advantages:

- Higher potential returns if invested wisely.

- Full control over investment decisions.

- No fund management fees.

❌ Disadvantages:

- High volatility and risk of loss.

- Requires extensive research and active monitoring.

- Emotional investing may lead to poor decisions.

4. Who Should Invest in Mutual Funds?

- Beginners who lack investment expertise.

- Individuals looking for a long-term, passive investment option.

- Investors seeking diversification to reduce risk.

- Those who want professional fund management.

5. Who Should Invest in Stocks?

- Investors with a high-risk appetite.

- Those willing to actively monitor and research stocks.

- Individuals looking for potentially higher returns.

- Investors who want full control over their investment decisions.

6. Factors to Consider Before Investing

a) Risk Tolerance

- If you have a low-risk tolerance, mutual funds may be a better option.

- If you are willing to take high risks for high rewards, stocks may be suitable.

b) Investment Horizon

- Short-Term: Stocks may provide quick returns but with higher volatility.

- Long-Term: Mutual funds, especially equity funds, are ideal for wealth creation.

c) Time Commitment

- Limited time? Choose mutual funds for passive investing.

- Willing to research? Stocks allow you to take control of your investments.

d) Costs and Fees

- Mutual funds charge expense ratios and exit loads.

- Stocks require brokerage fees and taxes on transactions.

7. Tax Implications of Mutual Funds vs. Stocks

| Investment Type | Short-Term Capital Gains (STCG) | Long-Term Capital Gains (LTCG) |

| Equity Mutual Funds | 15% (if held < 1 year) | 10% (if held > 1 year, above ₹1 lakh gains) |

| Debt Mutual Funds | Taxed as per income slab | Taxed as per income slab (from April 2023) |

| Stocks | 15% (if held < 1 year) | 10% (if held > 1 year, above ₹1 lakh gains) |

8. Conclusion: Which One Should You Choose?

- If you lack time or expertise, mutual funds are the safer and better option.

- If you want full control and can handle risks, stocks may be rewarding.

- A balanced approach: Investing in both mutual funds and stocks can help diversify your portfolio and optimize risk and returns.

Before investing, assess your financial goals, risk tolerance, and investment horizon. Consulting a financial advisor can also help in making an informed decision.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a financial expert before making any investment decisions.