The stock market has long been a subject of fascination, speculation, and myths. From Hollywood movies portraying dramatic crashes to friends and family sharing anecdotal advice, misconceptions about investing run rampant. These myths often discourage new investors or lead experienced ones to make ill-informed decisions. In this blog, we will debunk some of the most common stock market myths and provide clarity for those looking to navigate the market wisely.

Myth #1: Investing in Stocks Is Just Like Gambling

One of the most pervasive myths about the stock market is that it is no different from gambling. While both involve risk and uncertainty, they are fundamentally different.

Why This Myth Is Wrong:

- Ownership vs. Pure Chance – When you buy stocks, you are purchasing ownership in a company, whereas gambling involves staking money on an uncertain outcome with no underlying value.

- Long-Term Growth – The stock market has historically grown over time, rewarding disciplined investors. Gambling, on the other hand, often results in net losses.

- Strategic Decision-Making – Investors analyze financial reports, market trends, and economic indicators, whereas gamblers rely on luck.

Myth #2: You Need a Lot of Money to Start Investing

Many people believe that investing is only for the wealthy. This myth prevents small investors from taking advantage of the market’s growth potential.

Why This Myth Is Wrong:

- Fractional Shares – Many brokerages now allow you to buy fractions of expensive stocks, making it accessible even with a small budget.

- Low-Cost Index Funds – Exchange-traded funds (ETFs) and index funds allow diversification with a low initial investment.

- Compounding Power – Even small investments can grow significantly over time through the power of compounding.

Myth #3: A High Stock Price Means the Company Is Strong

Beginners often assume that expensive stocks are always better investments. However, a stock’s price alone does not determine its value.

Why This Myth Is Wrong:

- Price vs. Value – A high stock price does not necessarily indicate a strong company; valuation metrics like the price-to-earnings (P/E) ratio matter more.

- Stock Splits and Market Perception – Companies can split stocks to reduce prices without affecting overall valuation.

- Fundamentals Matter – Factors such as revenue growth, profitability, and competitive advantage should be considered before making an investment.

Myth #4: Timing the Market Is the Key to Success

Many investors believe they need to perfectly time their entry and exit points to make money in the stock market. However, even professional investors struggle with market timing.

Why This Myth Is Wrong:

- Consistency Beats Timing – Studies show that regular investing (dollar-cost averaging) outperforms attempts to time the market.

- Market Volatility – Short-term fluctuations are unpredictable, making it nearly impossible to consistently buy low and sell high.

- Long-Term Approach Wins – Historical data indicates that staying invested over time leads to significant wealth accumulation.

Myth #5: Stocks Always Go Up

While it’s true that the stock market tends to rise over long periods, individual stocks can decline or even become worthless.

Why This Myth Is Wrong:

- Market Cycles – Bear markets and economic downturns cause stock prices to fluctuate.

- Company Failures – Not all businesses succeed, and poor management or changing market conditions can lead to significant losses.

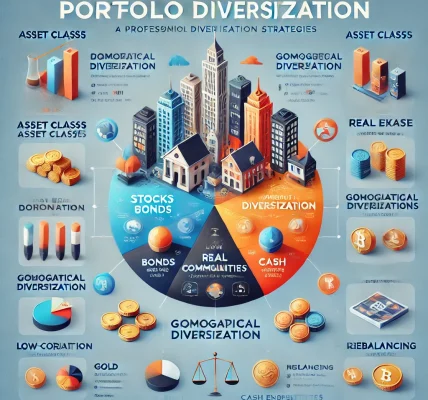

- Diversification Reduces Risk – Investing in a mix of assets instead of betting on a single stock is a more prudent strategy.

Myth #6: The Stock Market Is Only for Experts

Many people avoid investing because they believe they lack the necessary expertise. However, with the right resources, anyone can become a successful investor.

Why This Myth Is Wrong:

- Educational Resources Are Abundant – Books, online courses, and investment platforms provide valuable insights for beginners.

- Simple Investment Strategies Work – Passive investing in index funds requires minimal knowledge yet yields strong long-term returns.

- Financial Advisors Can Help – Investors who lack confidence can seek professional guidance for informed decision-making.

Myth #7: Dividends Are Always Safe

Dividend-paying stocks are often seen as safe investments, but this is not always true.

Why This Myth Is Wrong:

- Companies Can Cut Dividends – During financial downturns, companies may reduce or eliminate dividend payments.

- Not All Dividend Stocks Are Good Investments – Some high-yield stocks may be risky if the company’s fundamentals are weak.

- Growth vs. Income Investing – Investors must balance between growth stocks and dividend stocks based on their financial goals.

Myth #8: Past Performance Guarantees Future Results

One of the biggest misconceptions is that a stock that has performed well in the past will continue to do so in the future.

Why This Myth Is Wrong:

- Market Conditions Change – Economic shifts, regulatory changes, and technological advancements can alter a company’s prospects.

- Reversion to the Mean – Stocks that have grown excessively may experience corrections.

- Research Is Essential – Investors should focus on forward-looking analysis rather than past performance.

Myth #9: The Stock Market Is Rigged Against Small Investors

Some believe that only large institutions profit from the stock market while retail investors are at a disadvantage.

Why This Myth Is Wrong:

- Regulations Protect Investors – Regulatory bodies like the SEC oversee the market to prevent fraud and manipulation.

- Technology Levels the Playing Field – Retail investors now have access to real-time data, commission-free trading, and robo-advisors.

- Smart Strategies Yield Results – Educated investors who practice disciplined investing can achieve significant gains.

Conclusion

The stock market is filled with myths that can mislead investors and hinder wealth-building opportunities. By understanding and debunking these misconceptions, you can make more informed decisions and set yourself up for long-term success. Investing requires patience, education, and a strategic approach rather than following hearsay or attempting to time the market.

If you’re new to investing, start small, stay consistent, and continue learning. The more you understand about the stock market, the better equipped you’ll be to navigate its ups and downs. Happy investing!