Investing in international bonds offers investors a way to diversify their portfolios, tap into global economic growth, and potentially achieve higher returns. However, with these opportunities come unique risks and complexities. This comprehensive guide explores the world of international bonds, including their types, benefits, risks, and how to incorporate them into your investment strategy.

What Are International Bonds?

International bonds are debt securities issued by governments, corporations, or other entities outside an investor’s home country. These bonds allow investors to lend money to foreign issuers in exchange for periodic interest payments and the return of principal at maturity.

Types of International Bonds:

- Sovereign Bonds: Issued by foreign governments to fund public spending (e.g., U.S. Treasury Bonds, UK Gilts, Japanese Government Bonds).

- Corporate Bonds: Issued by multinational corporations to raise capital for business operations or expansion.

- Eurobonds: Bonds issued in a currency different from the country where they are sold (e.g., a U.S. dollar bond issued in Europe).

- Emerging Market Bonds: Issued by developing countries and typically offering higher yields to compensate for increased risk.

- Foreign Currency Bonds: Bonds issued in a currency other than the investor’s domestic currency.

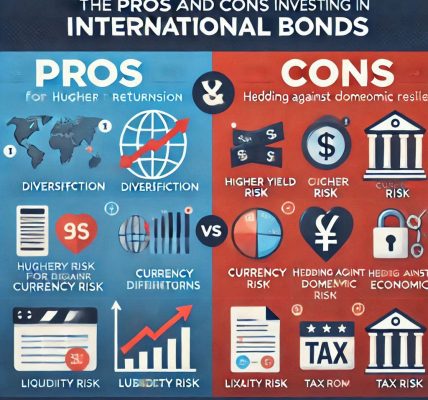

Benefits of Investing in International Bonds

International bonds provide several advantages that can enhance a well-rounded investment portfolio:

1. Global Diversification:

Investing in bonds from different countries spreads risk across various economies and reduces dependence on domestic markets.

2. Higher Yields:

Bonds from emerging markets or countries with higher interest rates may offer more attractive returns compared to domestic bonds.

3. Currency Diversification:

Investing in foreign bonds exposes investors to multiple currencies, which can protect against domestic currency devaluation.

4. Inflation Protection:

Some international bonds, especially from economies with rising inflation, can offer returns that outpace domestic inflation.

5. Access to New Markets:

International bonds enable investors to participate in growing and potentially lucrative economies worldwide.

Risks Associated with International Bonds

While international bonds offer attractive benefits, they also pose specific risks that investors should carefully consider:

1. Currency Risk:

Fluctuations in foreign exchange rates can impact the value of bond returns when converted to the investor’s home currency.

2. Political and Economic Risk:

Investing in foreign countries exposes investors to changes in political stability, government policies, and economic performance.

3. Credit Risk:

Foreign issuers may default on payments due to financial instability or political turmoil, especially in emerging markets.

4. Liquidity Risk:

Some international bonds may have lower trading volumes, making it harder to sell them quickly without impacting the price.

5. Interest Rate Risk:

Like domestic bonds, international bonds are affected by changes in global interest rates, which can influence bond prices.

Evaluating International Bonds: Key Metrics

When assessing international bonds, investors should consider several crucial factors:

- Yield to Maturity (YTM): The total return expected if the bond is held until maturity, accounting for interest payments and principal repayment.

- Credit Rating: Ratings from agencies like Moody’s, S&P, and Fitch indicate the issuer’s creditworthiness and likelihood of repayment.

- Currency Exchange Rates: Monitor currency fluctuations that can either enhance or erode returns on foreign bonds.

- Country Risk Assessment: Evaluate the political and economic environment of the issuing country to identify potential risks.

- Duration: Measures a bond’s sensitivity to interest rate changes; longer durations typically indicate greater risk.

How to Invest in International Bonds

Investors can access international bonds through several avenues, depending on their risk tolerance and investment goals:

1. Direct Purchase:

Buy foreign bonds through international brokerages or directly from foreign governments or corporations.

2. Global Bond Funds:

Mutual funds or Exchange-Traded Funds (ETFs) offer diversified exposure to international bonds, reducing individual security risk.

3. Government Bond Programs:

Some countries allow foreign investors to buy sovereign bonds directly through official programs.

4. Eurobonds:

Available through major financial institutions, Eurobonds provide currency diversification and access to multinational issuers.

5. Institutional Investment Platforms:

Sophisticated investors may access international bonds via specialized platforms offering broader market exposure.

Tax Implications of International Bonds

Tax treatment for international bond investments varies by country and depends on the investor’s residence. Key considerations include:

- Withholding Taxes: Many foreign governments levy taxes on interest payments to non-residents.

- Capital Gains Tax: Profits from the sale of international bonds may be subject to domestic capital gains taxes.

- Tax Treaties: Bilateral tax treaties between countries may reduce or eliminate double taxation on bond income.

Always consult a tax advisor to understand the specific tax implications in your jurisdiction.

Are International Bonds Right for You?

International bonds are suitable for investors seeking:

- Diversification: Exposure to global markets and reduced reliance on domestic economies.

- Higher Returns: Potentially better yields, especially in emerging markets.

- Currency Hedging: Protection against domestic currency devaluation.

However, they may not be ideal for risk-averse investors due to currency volatility, political uncertainties, and credit risks.

Best Practices for International Bond Investing

To maximize returns and mitigate risks, follow these best practices:

- Diversify Across Regions and Currencies: Spread investments across different countries and currencies to reduce localized risks.

- Monitor Economic and Political Conditions: Stay informed about the macroeconomic environment and policy changes in issuing countries.

- Use Hedging Strategies: Consider currency hedging to protect against adverse exchange rate movements.

- Review Bond Ratings Regularly: Track changes in credit ratings to evaluate issuer stability and default risk.

- Consult Financial Experts: Work with experienced financial advisors to tailor international bond investments to your objectives.

Conclusion

International bonds present a unique opportunity to diversify, enhance returns, and gain exposure to global markets. By understanding their structure, benefits, and risks, investors can make informed decisions and strategically integrate international bonds into their portfolios.

As with any investment, thorough research and professional guidance are essential to navigating the complexities of international bond investing while managing risk effectively.