When it comes to investing in bonds, understanding how to calculate bond prices and yields is crucial for making informed decisions. Bonds are considered safer investments compared to stocks, and they provide a predictable stream of income through interest payments. However, just like any other financial instrument, bonds are subject to various factors that affect their pricing and returns. In this blog, we’ll break down the basics of bond pricing and yield calculation in simple terms, helping you become a more knowledgeable investor.

What is a Bond?

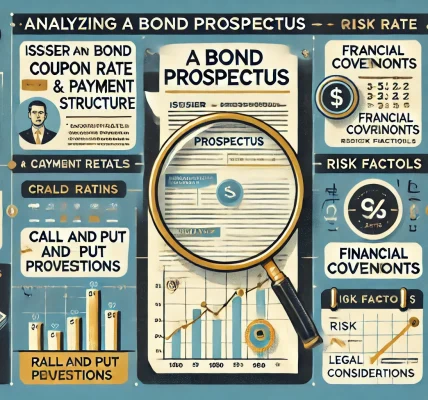

A bond is essentially a debt security. When you purchase a bond, you are lending money to a government, corporation, or another entity. In return, the issuer promises to pay you interest (referred to as the coupon) over the life of the bond and return the principal (the bond’s face value) when the bond matures.

What Factors Influence Bond Prices?

The price of a bond is influenced by several key factors, including:

- Interest Rates: When interest rates rise, the price of existing bonds tends to fall. This is because newer bonds are issued with higher yields, making older bonds with lower rates less attractive. Conversely, when interest rates fall, bond prices tend to rise.

- Credit Quality of the Issuer: If the issuer’s credit rating improves (i.e., they are less likely to default), the bond price tends to increase. On the other hand, if the issuer’s credit rating deteriorates, the bond price may decrease as the risk increases.

- Time to Maturity: The closer a bond gets to its maturity date, the more its price will converge toward its face value. If you hold the bond until maturity, you will receive the face value at that time, regardless of the price you paid for the bond.

How to Calculate Bond Prices?

To calculate the price of a bond, we need to calculate the present value of its future cash flows. A bond’s future cash flows consist of periodic coupon payments and the repayment of the principal at maturity. The general formula for calculating bond prices is:Bond Price=∑t=1TC(1+r)t+F(1+r)T\text{Bond Price} = \sum_{t=1}^{T} \frac{C}{(1+r)^t} + \frac{F}{(1+r)^T}Bond Price=t=1∑T(1+r)tC+(1+r)TF

Where:

- CCC = Coupon payment (annual interest)

- rrr = Market interest rate (expressed as a decimal)

- TTT = Total number of periods (years to maturity)

- FFF = Face value of the bond (the principal amount)

In simpler terms, you are calculating the present value of all future payments (coupon payments and the principal repayment) based on the current market interest rate.

Example of Bond Price Calculation

Let’s walk through an example to better understand how bond prices are calculated.

Example:

You are considering purchasing a 5-year bond with the following details:

- Face value: $1,000

- Annual coupon rate: 6% (i.e., the bond pays $60 in interest every year)

- Market interest rate: 5%

To calculate the bond price, we need to discount each of the future coupon payments and the face value (principal) at maturity back to the present using the market interest rate.

Step-by-Step Calculation:

- Coupon Payments: Since the bond pays $60 in interest every year, the present value of each coupon payment is calculated by discounting it to the present using the market interest rate of 5%.

- Principal Repayment: At maturity, you will receive the face value of $1,000. This is discounted back to the present using the same market interest rate.

By calculating the present values of the coupon payments and principal repayment and adding them up, you’ll arrive at the price of the bond.

How to Calculate Bond Yield?

Bond yield is the return an investor can expect to earn if the bond is held until maturity. There are different types of yields that you can calculate depending on the information you have. The most common types of bond yields are:

- Current Yield: This is the bond’s annual coupon payment divided by its current market price.

Current Yield=Coupon PaymentCurrent Market Price\text{Current Yield} = \frac{\text{Coupon Payment}}{\text{Current Market Price}}Current Yield=Current Market PriceCoupon Payment

For example, if a bond pays $60 in interest and the current market price is $1,200, the current yield is:\text{Current Yield} = \frac{60}{1200} = 0.05 \text{ or 5%}

- Yield to Maturity (YTM): This is the total return an investor can expect if the bond is held to maturity. YTM takes into account the bond’s current price, coupon payments, and the face value repayment at maturity.

The formula for YTM is more complex and requires iterative methods or a financial calculator to calculate precisely. However, the general concept is that it considers the time value of money for all cash flows associated with the bond.

Why is Understanding Bond Pricing and Yields Important?

- Investment Decision Making: Knowing how to calculate bond prices and yields helps investors assess whether a bond is priced attractively relative to its yield. It also allows them to compare different bonds and decide which ones fit their investment strategy.

- Market Conditions: Bond prices and yields are closely tied to market conditions. By understanding how they work, investors can make more informed decisions when interest rates change or when bond prices fluctuate due to market events.

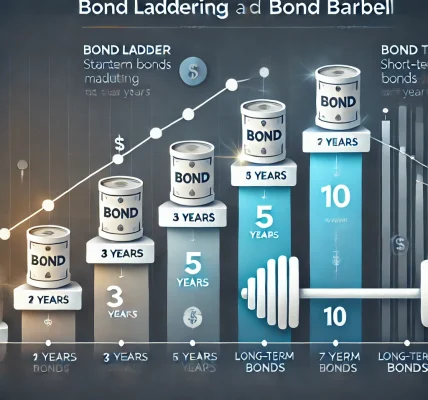

- Diversification: Bonds are a key part of any diversified portfolio. By understanding bond pricing and yields, you can strategically include them in your portfolio to balance risk and returns.

Conclusion

Calculating bond prices and yields may seem complicated at first, but with a basic understanding of the formulas and concepts, it becomes easier to make informed investment decisions. Whether you’re interested in municipal bonds, corporate bonds, or treasury bonds, knowing how to assess their price and yield is essential for maximizing returns and managing risk.

By learning how to calculate bond prices and yields, you can create a more effective and diversified investment strategy that works toward your financial goals.