Investing in bonds is a popular strategy for generating income, preserving capital, and diversifying an investment portfolio. Within the bond market, one critical decision investors face is choosing between short-term and long-term bonds. Each option offers distinct advantages and disadvantages, and understanding their differences can help you make informed investment decisions.

In this comprehensive guide, we will explore the pros and cons of short-term and long-term bonds, their unique characteristics, and the best use cases for each. This knowledge will empower you to align your bond investments with your financial goals and risk tolerance.

What Are Bonds?

A bond is a fixed-income security representing a loan made by an investor to a borrower, typically a corporation, municipality, or government. In return, the issuer agrees to pay periodic interest (coupon payments) and repay the bond’s face value upon maturity.

Key Bond Terms to Know

- Face Value (Par Value): The amount the issuer repays at maturity.

- Coupon Rate: The annual interest payment as a percentage of the bond’s face value.

- Maturity Date: The date when the bond’s principal is repaid.

- Yield: The effective return an investor earns on a bond.

Understanding Short-Term and Long-Term Bonds

Short-Term Bonds

Short-term bonds typically have maturities of less than five years. They are often issued by governments, corporations, and municipalities, offering lower yields but greater liquidity and stability.

Examples of Short-Term Bonds:

- Treasury bills (T-bills)

- Corporate bonds (with maturities under five years)

- Municipal bonds (short duration)

Long-Term Bonds

Long-term bonds generally have maturities exceeding ten years, sometimes extending up to 30 years or more. They offer higher yields due to their longer duration but come with increased exposure to interest rate risk.

Examples of Long-Term Bonds:

- Treasury bonds (T-bonds)

- Long-term corporate bonds

- Municipal bonds with extended maturity

Pros and Cons of Short-Term Bonds

Pros

- Lower Interest Rate Risk:

- Short-term bonds are less sensitive to interest rate fluctuations, making them a safer option when rates rise.

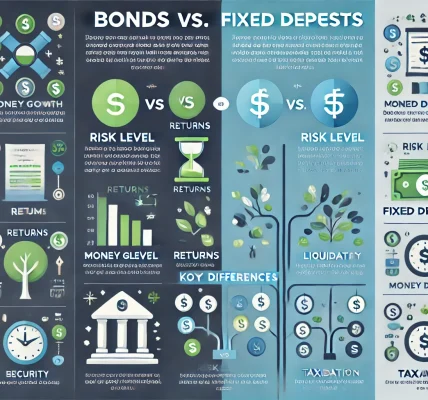

- Higher Liquidity:

- Easier to sell in the secondary market due to shorter maturities and higher demand.

- Stability and Predictability:

- Less volatility in price compared to long-term bonds.

- Flexibility:

- Frequent maturity dates allow for reinvestment opportunities at potentially higher rates.

Cons

- Lower Yields:

- Typically offer lower returns compared to long-term bonds.

- Reinvestment Risk:

- If interest rates fall, reinvesting matured bonds could result in lower yields.

- Inflation Vulnerability:

- Returns may not keep pace with inflation over extended periods.

Pros and Cons of Long-Term Bonds

Pros

- Higher Yields:

- Longer maturities typically offer better interest rates, enhancing income potential.

- Stable Income:

- Provides consistent and predictable coupon payments over an extended period.

- Diversification:

- Helps diversify a portfolio, especially during periods of economic uncertainty.

Cons

- Greater Interest Rate Risk:

- More sensitive to changes in interest rates, leading to larger price fluctuations.

- Lower Liquidity:

- Harder to sell quickly without impacting the market price.

- Inflation Erosion:

- Fixed coupon payments lose purchasing power as inflation rises over time.

Key Factors to Consider When Choosing Between Short-Term and Long-Term Bonds

- Interest Rate Environment:

- In a rising rate environment, short-term bonds are preferable due to lower sensitivity.

- In a falling rate environment, long-term bonds offer higher yields and price appreciation.

- Investment Horizon:

- Short-term bonds are suitable for investors needing capital in the near future.

- Long-term bonds work best for those with extended time horizons seeking consistent income.

- Risk Tolerance:

- Conservative investors may prefer short-term bonds for their stability.

- Aggressive investors willing to accept more risk may opt for long-term bonds.

- Inflation Outlook:

- If inflation is expected to rise, short-term bonds mitigate the risk of diminishing purchasing power.

- In a low-inflation environment, long-term bonds provide attractive yields.

Best Use Cases for Short-Term and Long-Term Bonds

When to Choose Short-Term Bonds

- Preserving Capital: Ideal for risk-averse investors seeking principal protection.

- Emergency Funds: Provides liquidity while earning modest returns.

- Rising Interest Rates: Limits exposure to declining bond prices.

- Near-Term Goals: Suitable for funding expenses within a few years (e.g., home purchase, education).

When to Choose Long-Term Bonds

- Income Generation: Provides higher and more consistent coupon payments.

- Diversification: Balances a portfolio with fixed-income assets.

- Falling Interest Rates: Increases in value as rates decline.

- Retirement Planning: Offers a reliable income stream for future needs.

Combining Short-Term and Long-Term Bonds: The Barbell Strategy

A popular approach is the barbell strategy, where investors hold both short-term and long-term bonds while avoiding intermediate maturities. This allows for:

- Flexibility: Short-term bonds provide liquidity.

- Higher Yields: Long-term bonds generate greater income.

- Risk Management: Mitigates interest rate and reinvestment risks.

Conclusion

Choosing between short-term and long-term bonds depends on your financial goals, risk tolerance, and the prevailing economic environment. Short-term bonds offer stability and liquidity, making them ideal for conservative investors and near-term needs. In contrast, long-term bonds provide higher yields and are better suited for income-focused, long-term strategies.

By understanding the unique advantages and risks of each type of bond, you can build a diversified bond portfolio that aligns with your investment objectives. Always consider consulting with a financial advisor to tailor your bond investments to your specific needs and market conditions.