Understanding the relationship between interest rates and bond prices is essential for any investor looking to navigate the fixed-income market effectively. Interest rates play a significant role in determining bond yields, prices, and overall investment returns. Whether you’re a seasoned investor or new to bonds, knowing how interest rates affect bond prices can help you make informed decisions and optimize your portfolio.

In this guide, we will explore the dynamics between bond prices and interest rates, the factors influencing this relationship, and strategies to manage the risks associated with interest rate fluctuations.

What Are Bonds and How Do They Work?

A bond is a fixed-income security issued by governments, corporations, or other entities to raise capital. When you purchase a bond, you are effectively lending money to the issuer in exchange for periodic interest payments (also known as coupon payments) and the return of the bond’s face value upon maturity.

Key Bond Terms to Understand

- Face Value (Par Value): The amount the issuer agrees to pay back at maturity.

- Coupon Rate: The fixed interest rate paid to the bondholder, usually expressed as a percentage of the face value.

- Maturity Date: The date on which the issuer repays the bond’s face value.

- Yield: The annual return on a bond based on its current price.

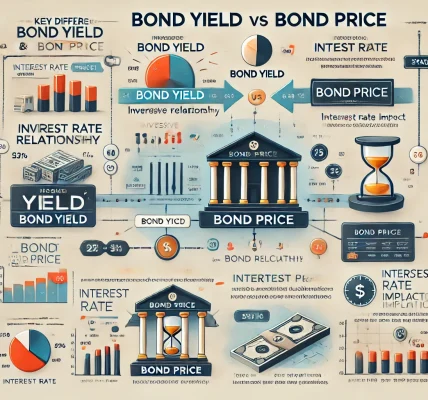

The Inverse Relationship Between Bond Prices and Interest Rates

One of the fundamental principles of bond investing is the inverse relationship between bond prices and interest rates. When interest rates rise, bond prices typically fall. Conversely, when interest rates decline, bond prices tend to increase.

Why Do Bond Prices Fall When Interest Rates Rise?

When new bonds are issued with higher coupon rates due to rising interest rates, existing bonds with lower coupon rates become less attractive to investors. To compensate for their lower yields, these older bonds must be sold at a discount, causing their market prices to drop.

Example:

- Imagine you own a bond with a $1,000 face value and a 4% coupon rate.

- If interest rates rise to 6%, new bonds offer a better return.

- To sell your 4% bond, you must lower its price to make it competitive.

Why Do Bond Prices Rise When Interest Rates Fall?

When interest rates decrease, newly issued bonds offer lower yields. Older bonds with higher coupon rates become more desirable, driving up their market prices.

Factors Influencing the Impact of Interest Rates on Bond Prices

1. Bond Maturity

The time remaining until a bond matures significantly affects how sensitive it is to interest rate changes. Longer-term bonds experience greater price fluctuations compared to shorter-term bonds.

- Short-Term Bonds: Less sensitive to interest rate changes due to quicker maturity.

- Long-Term Bonds: More sensitive because future coupon payments become less valuable when discounted at higher rates.

2. Coupon Rate

Bonds with lower coupon rates are more affected by interest rate changes than those with higher coupon rates. This is because lower-coupon bonds provide smaller cash flows, making their present value more susceptible to shifts in interest rates.

3. Market Conditions

Broader economic factors, including inflation, monetary policy, and market sentiment, can impact both interest rates and bond price volatility.

Measuring Interest Rate Sensitivity: Duration and Convexity

1. Duration

Duration measures a bond’s sensitivity to interest rate changes. It estimates how much a bond’s price is likely to change for a 1% change in interest rates.

- Modified Duration: Reflects the percentage change in a bond’s price for each 1% change in interest rates.

Example: If a bond has a duration of 5 years, its price will decrease by approximately 5% if interest rates rise by 1%.

2. Convexity

Convexity measures the curvature in the relationship between bond prices and interest rates. It accounts for how duration changes as interest rates fluctuate, providing a more accurate measure for large interest rate movements.

Strategies to Manage Interest Rate Risk

1. Diversify Your Bond Portfolio

Investing in a mix of short-term, medium-term, and long-term bonds can help spread interest rate risk. Different maturities react differently to interest rate changes, reducing overall portfolio volatility.

2. Implement a Bond Ladder Strategy

A bond ladder involves purchasing bonds with staggered maturities. As each bond matures, you reinvest the proceeds into a new bond with a longer maturity, balancing interest rate exposure over time.

3. Focus on Floating-Rate Bonds

Floating-rate bonds offer variable coupon payments that adjust with changes in interest rates, making them less sensitive to rate hikes.

4. Invest in Bond Funds

Bond mutual funds and exchange-traded funds (ETFs) provide instant diversification across different bond types and maturities, reducing the impact of interest rate changes on individual bonds.

How Central Banks Influence Interest Rates

Central banks, such as the Federal Reserve in the United States, play a critical role in setting interest rates through monetary policy. They adjust rates to control inflation, promote employment, and stabilize the economy.

- Rising Interest Rates: Typically implemented to combat inflation, making borrowing more expensive and reducing bond prices.

- Lowering Interest Rates: Aimed at stimulating economic growth, which increases bond prices by reducing the yield on new bonds.

Practical Considerations for Bond Investors

- Understand Your Risk Tolerance: Determine how much interest rate risk you are willing to accept based on your investment goals and time horizon.

- Monitor Market Trends: Keep track of central bank policies and economic indicators to anticipate interest rate changes.

- Rebalance Your Portfolio: Regularly review and adjust your bond holdings to maintain your desired risk level.

Conclusion

The relationship between interest rates and bond prices is a critical concept for any bond investor to understand. As interest rates fluctuate, bond prices respond inversely, impacting your portfolio’s value and income potential. By employing strategies like diversification, bond ladders, and focusing on duration, you can effectively manage interest rate risks while optimizing returns.

Always stay informed about economic conditions and consult with a financial advisor if needed to align your bond investments with your broader financial objectives.