Investing in bonds can provide stability, predictable income, and diversification to your financial portfolio. However, bond investments are not without risks, particularly interest rate fluctuations and reinvestment uncertainty. One effective way to mitigate these risks while maximizing returns is through a bond laddering strategy. This guide will explain what bond laddering is, how it works, its benefits, potential drawbacks, and how to implement it effectively.

What Is Bond Laddering?

Bond laddering is an investment strategy where you purchase bonds with different maturity dates, spreading your investments across a “ladder” of time intervals. As each bond matures, you reinvest the proceeds into a new bond with the longest term on your ladder. This staggered approach reduces the impact of interest rate changes and helps maintain a consistent cash flow.

For example, instead of investing $100,000 in a single 10-year bond, you could invest $20,000 each in 1-year, 3-year, 5-year, 7-year, and 10-year bonds. When the 1-year bond matures, you reinvest the proceeds into a new 10-year bond, continuing the ladder.

How Does Bond Laddering Work?

- Divide Your Investment: Allocate your total investment across bonds with various maturities (e.g., 1, 3, 5, 7, and 10 years).

- Hold Bonds Until Maturity: As each bond matures, reinvest the principal into a new bond with the longest term in your ladder.

- Repeat the Process: Continue the cycle, maintaining your ladder and benefiting from consistent returns.

Example of a 5-Year Bond Ladder

| Bond | Maturity Date | Investment Amount | Interest Rate |

|---|---|---|---|

| Bond A | 1 Year | $20,000 | 3.0% |

| Bond B | 3 Years | $20,000 | 3.5% |

| Bond C | 5 Years | $20,000 | 4.0% |

| Bond D | 7 Years | $20,000 | 4.5% |

| Bond E | 10 Years | $20,000 | 5.0% |

When Bond A matures after 1 year, you reinvest that $20,000 into a new 10-year bond, keeping your ladder intact.

Benefits of Bond Laddering

1. Reduces Interest Rate Risk

Interest rates fluctuate over time. By spreading your investments across multiple maturities, you avoid locking all your money in at a low rate or missing future rate increases. If rates rise, the maturing bonds allow you to reinvest at higher yields.

2. Provides Consistent Income

As bonds mature, you receive a steady cash flow that can be used for living expenses or reinvestment. This is particularly beneficial for retirees seeking reliable income.

3. Enhances Liquidity

Since a portion of your investment matures periodically, you gain access to regular cash without having to sell bonds at potentially unfavorable prices.

4. Diversifies Your Portfolio

A bond ladder helps diversify both maturity dates and interest rate exposure. This reduces the risk of being overly reliant on any single bond or maturity period.

5. Mitigates Reinvestment Risk

By reinvesting gradually as bonds mature, you spread the risk of future interest rate fluctuations. This can help avoid the problem of reinvesting large sums at low rates.

Potential Drawbacks of Bond Laddering

1. Lower Returns in Rising Markets

If interest rates fall after you build your ladder, the bonds with longer maturities may yield lower returns compared to new bonds offering higher rates.

2. Complexity of Management

Managing a bond ladder requires tracking multiple bonds, their maturity dates, and reinvestment decisions. For larger portfolios, this can become time-consuming without proper tools or professional assistance.

3. Transaction Costs

Buying and reinvesting in bonds can incur transaction fees or brokerage charges, which may reduce overall returns, particularly for smaller ladders.

How to Build a Bond Ladder

1. Determine Your Investment Amount

Decide how much capital you want to allocate to your bond ladder. Ensure it aligns with your financial goals and risk tolerance.

2. Choose Your Ladder Length

Select the time frame for your ladder based on your needs:

- Short-term ladder (1-5 years): Suitable for conservative investors seeking liquidity.

- Medium-term ladder (5-10 years): Balanced approach offering steady income and growth potential.

- Long-term ladder (10+ years): Ideal for maximizing yield over extended periods while mitigating reinvestment risk.

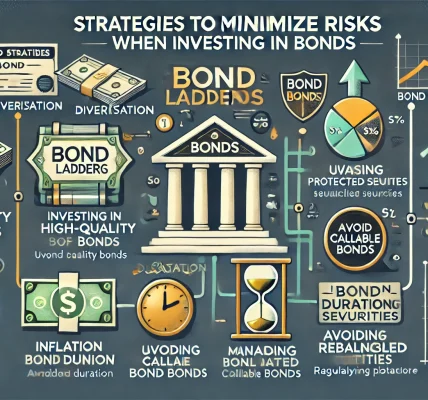

3. Select Quality Bonds

Choose bonds from reputable issuers to minimize default risk. Consider:

- Government Bonds: U.S. Treasuries and municipal bonds offer high safety.

- Corporate Bonds: Higher yields but greater credit risk; focus on investment-grade bonds.

- Agency Bonds: Issued by government-sponsored entities, offering moderate yields and low risk.

4. Purchase Bonds with Staggered Maturities

Spread your investment evenly across the selected maturity intervals. For instance, a $100,000 ladder over 10 years might involve purchasing five $20,000 bonds maturing every two years.

5. Monitor and Reinvest

Regularly track your ladder and reinvest proceeds as bonds mature to maintain its structure.

Bond Laddering vs. Other Bond Strategies

| Feature | Bond Laddering | Bullet Strategy | Barbell Strategy |

| Definition | Staggered maturities | Single maturity point | Short & long maturities |

| Risk Mitigation | Moderate risk balance | High reinvestment risk | Medium risk, high yield |

| Income Consistency | Regular cash flow | One-time payment | Variable cash flow |

| Best For | Balanced investors | Specific future goals | Yield maximization |

Who Should Use a Bond Ladder?

- Retirees: Seeking consistent income and capital preservation.

- Conservative Investors: Prioritizing reduced risk and liquidity.

- Long-Term Planners: Diversifying investments while mitigating reinvestment and interest rate risks.

Final Thoughts

A bond laddering strategy is a powerful tool for reducing risk and optimizing returns. By diversifying maturities, maintaining liquidity, and reinvesting systematically, investors can protect themselves from interest rate volatility and achieve their financial goals.

Before building a bond ladder, assess your financial needs, select appropriate bonds, and monitor your strategy regularly. If you are unsure or managing substantial sums, consulting a financial advisor can provide valuable guidance and ensure your ladder aligns with your long-term objectives.