Introduction

Investing in bonds is a popular strategy for individuals seeking stable, predictable income. However, the challenge for many investors is ensuring that their bond portfolio can adapt to fluctuating interest rates, provide consistent returns, and manage risk effectively. One of the most powerful techniques for achieving this is building a bond ladder.

A bond ladder is a strategy where you invest in multiple bonds with different maturity dates. This strategy not only helps spread risk but also ensures that you have a steady stream of income as the bonds mature over time. In this blog, we’ll explore the ins and outs of building a bond ladder, how it can benefit your investment portfolio, and step-by-step instructions on how to implement it.

What is a Bond Ladder?

A bond ladder is a strategy where you buy a series of bonds with staggered maturity dates. For example, you may buy bonds that mature in one year, three years, five years, seven years, and so on. This approach helps manage interest rate risk and provides liquidity as bonds mature at regular intervals. As each bond matures, you can reinvest the proceeds into new bonds, potentially at higher interest rates, keeping your ladder intact.

By using this approach, investors ensure that their portfolio is more resilient to changes in the interest rate environment and that they receive a predictable income stream throughout the life of the investment.

Why Build a Bond Ladder?

Before diving into the process, let’s explore some of the key benefits of building a bond ladder:

- Minimized Interest Rate Risk: A bond ladder mitigates interest rate risk by spreading your investments across multiple time periods. If interest rates rise, only a portion of your bonds will be impacted, reducing overall volatility in your portfolio.

- Consistent Cash Flow: A bond ladder ensures that you have bonds maturing regularly. This provides a predictable cash flow, making it easier to plan for future expenses or reinvest the proceeds.

- Diversification: Laddering bonds across different maturities allows you to diversify your interest rate exposure. It also spreads out the risk of holding bonds with varying credit risks and durations.

- Liquidity: As each bond in the ladder matures, you receive your principal, which you can reinvest or use for other purposes. This provides regular access to cash without having to sell bonds prematurely.

How to Build a Bond Ladder: Step-by-Step

Step 1: Determine Your Investment Goals

The first step in building a bond ladder is to clearly define your investment goals. Are you looking for regular income to cover expenses? Are you saving for a future purchase or event? Your goals will influence the types of bonds you choose, as well as the duration of the ladder.

- If your goal is to generate steady income, shorter-duration bonds may be a better fit, as they mature quickly and provide a reliable cash flow.

- For long-term goals, you may choose longer-duration bonds to lock in higher yields over time.

Step 2: Select the Right Bonds for Your Ladder

Once you’ve defined your investment goals, you’ll need to select the types of bonds to include in your ladder. Some options include:

- Government Bonds: U.S. Treasury Bonds or municipal bonds are relatively low-risk and can be a safe option for your bond ladder. These bonds typically offer stable returns and are less susceptible to credit risk.

- Corporate Bonds: These bonds can offer higher yields, but they come with greater risk, especially if the issuer’s credit rating is lower. Choose bonds from companies with a strong credit rating to reduce the likelihood of default.

- Bond Funds or ETFs: If you don’t want to select individual bonds, you can use bond funds or exchange-traded funds (ETFs) that provide exposure to a variety of bonds. However, these funds are less predictable than individual bonds, as their value can fluctuate based on the performance of the underlying securities.

Step 3: Choose Your Maturity Dates

Now that you know which bonds you’ll invest in, it’s time to choose your maturity dates. Typically, investors use a range of 1 to 10 years for their bond ladder, but you can structure your ladder with any maturities that suit your goals. For example:

- Short-Term Bonds (1-3 years): These bonds are more sensitive to changes in interest rates but offer liquidity and stability.

- Medium-Term Bonds (3-7 years): These bonds strike a balance between yield and interest rate sensitivity, making them an excellent option for a diversified ladder.

- Long-Term Bonds (7+ years): These bonds provide higher yields but come with more interest rate risk. They are ideal for investors with a longer time horizon.

Make sure to stagger your bonds so that they mature at different intervals. For instance, you could buy bonds maturing in 1, 3, 5, 7, and 10 years. This will ensure a regular stream of income as the bonds mature.

Step 4: Invest and Monitor

After setting up your bond ladder, you can start investing. It’s important to track the performance of your bonds and stay informed about any changes in interest rates, credit ratings, or the financial health of the issuers.

- Reinvesting Maturing Bonds: As each bond matures, you’ll need to reinvest the proceeds into a new bond at a similar maturity level. This will help maintain your bond ladder and ensure a steady income stream.

- Rebalancing: Over time, the composition of your bond ladder may change due to interest rate fluctuations or changes in your investment goals. Regularly rebalance your ladder to ensure it still aligns with your objectives.

Step 5: Assess Your Tax Situation

Lastly, consider the tax implications of the bonds in your ladder. Some bonds, such as municipal bonds, are tax-exempt, while others, like corporate bonds, are subject to income tax on the interest earned. Ensure that your bond ladder strategy aligns with your tax planning goals.

Common Mistakes to Avoid

While a bond ladder can be a highly effective strategy, there are a few common mistakes that investors should avoid:

- Not Diversifying Properly: It’s essential to include bonds with different credit qualities and durations to ensure your ladder is well-diversified and resilient to market changes.

- Overlooking Liquidity Needs: Keep in mind your future liquidity needs. If you need access to cash quickly, consider including some shorter-term bonds in your ladder to provide more frequent maturities.

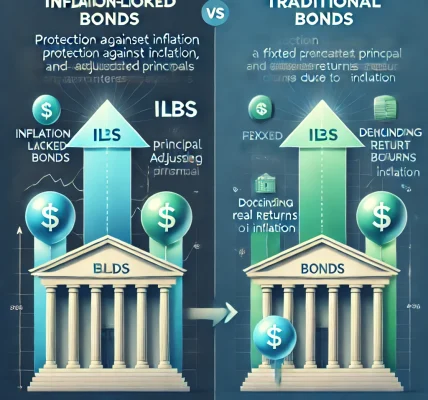

- Ignoring Inflation Risk: While bond ladders can help reduce interest rate risk, they don’t protect against inflation. To mitigate this, consider adding inflation-protected securities to your ladder.

Conclusion

Building a bond ladder is a simple yet effective strategy to generate consistent returns and manage risk in your investment portfolio. By carefully selecting bonds with varying maturities, credit ratings, and yields, you can ensure a steady cash flow, reduce interest rate risk, and maintain a balanced portfolio.

Whether you’re an experienced investor or just starting, building a bond ladder allows you to tailor your investments to your financial goals while minimizing risk. If done correctly, a bond ladder can become a cornerstone of a stable, diversified portfolio for years to come.