Investing in bonds is one of the most reliable ways to grow your wealth over time. Bonds are often considered a safer investment option compared to stocks, making them ideal for risk-averse investors or those looking for steady income. In this guide, we’ll delve into what bonds are, how they work, and why they might be a valuable addition to your investment portfolio.

What Are Bonds?

A bond is essentially a loan made by an investor to a borrower, typically a corporation, municipality, or government. When you purchase a bond, you are lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value when it matures.

Key Features of Bonds

- Issuer: The entity borrowing the funds, such as a company or government.

- Face Value: The principal amount of the bond that is repaid at maturity.

- Coupon Rate: The interest rate the bond pays, typically expressed as a percentage of the face value.

- Maturity Date: The date when the bond’s principal is repaid.

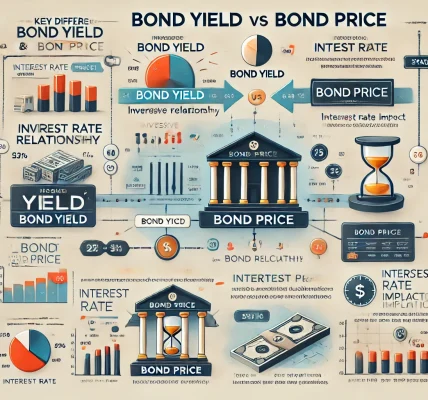

- Yield: The rate of return you earn on the bond, factoring in its price and coupon payments.

How Do Bonds Work?

When you buy a bond:

- You pay the bond’s purchase price.

- The issuer agrees to pay you periodic interest (known as coupon payments) for the duration of the bond’s term.

- At maturity, the issuer returns your original investment (face value).

For example, if you buy a bond with a face value of INR 10,000, a coupon rate of 5%, and a 10-year maturity, you’ll receive INR 500 annually as interest and INR 10,000 at the end of 10 years.

Types of Bonds

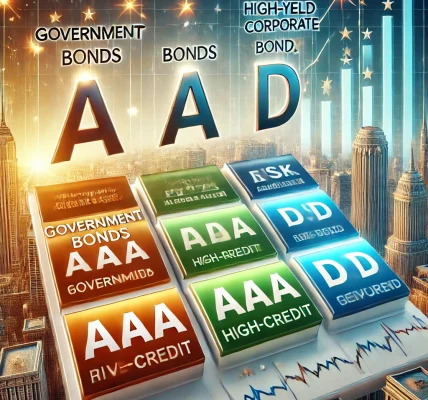

- Government Bonds: Issued by national or state governments. Examples include Treasury bonds in the U.S. or sovereign bonds in India.

- Corporate Bonds: Issued by companies to raise capital. These often offer higher returns but come with higher risk.

- Municipal Bonds: Issued by local governments or municipalities to fund public projects.

- Zero-Coupon Bonds: These don’t pay periodic interest but are sold at a discount and redeemed at full value at maturity.

- Convertible Bonds: These can be converted into a company’s stock, offering potential for capital appreciation.

Why Invest in Bonds?

- Stability and Predictability: Bonds provide steady and predictable returns through fixed interest payments.

- Diversification: They balance out the volatility of stocks in a diversified portfolio.

- Income Generation: Ideal for retirees or those seeking regular income.

- Capital Preservation: Government bonds, in particular, are considered safe investments.

Risks Associated with Bonds

- Interest Rate Risk: Bond prices fall when interest rates rise.

- Credit Risk: The issuer may default on interest or principal payments.

- Inflation Risk: Rising inflation can erode the purchasing power of bond returns.

- Liquidity Risk: Some bonds may be difficult to sell quickly at fair market value.

How to Invest in Bonds

- Direct Purchase: Buy bonds directly from issuers or in the secondary market.

- Bond Funds: Invest in mutual funds or exchange-traded funds (ETFs) that hold a diversified portfolio of bonds.

- Online Platforms: Many investment platforms offer access to government and corporate bonds.

- Through Brokers: Financial advisors or brokers can guide you in selecting bonds that suit your goals.

Pro Tips for Bond Investors

- Match Bonds to Your Goals: Align bond maturities with your financial goals.

- Check Credit Ratings: Opt for bonds with high ratings from agencies like CRISIL or Moody’s.

- Diversify: Spread your investments across different issuers and types of bonds to minimize risk.

- Monitor Market Trends: Keep an eye on interest rates and inflation trends.

Conclusion

Bonds are an essential component of a well-rounded investment portfolio, offering stability, income, and diversification. By understanding their mechanics and risks, you can make informed decisions that align with your financial goals. Whether you are a seasoned investor or just starting, adding bonds to your portfolio can provide a sense of security and steady growth over time.