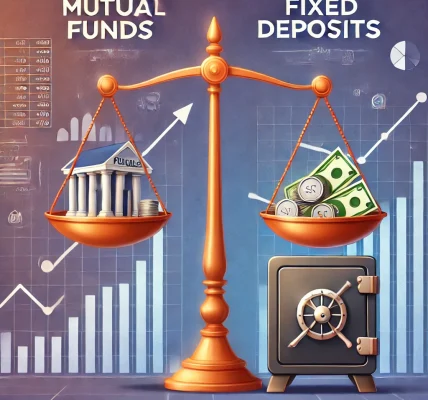

Investing in mutual funds and exchange-traded funds (ETFs) is a common way to build wealth over time. Both of these investment vehicles allow individuals to invest in diversified portfolios of stocks, bonds, or other assets. However, they differ in terms of structure, trading flexibility, cost, and tax efficiency. If you’re looking to choose the best option for your portfolio, it’s essential to understand the key differences and evaluate which one aligns with your investment goals.

What Are Mutual Funds?

Mutual funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. They are actively managed by a fund manager or a team who make decisions about which assets to buy or sell. Mutual funds are bought and sold at the end of each trading day at the net asset value (NAV) of the fund.

Pros of Mutual Funds:

- Active Management: Professional fund managers handle the portfolio, making decisions based on market conditions.

- Automatic Reinvestment: Dividends and capital gains can be automatically reinvested, compounding growth over time.

- No Minimum Investment for Many Funds: Some mutual funds have low minimum investments, making them accessible for new investors.

Cons of Mutual Funds:

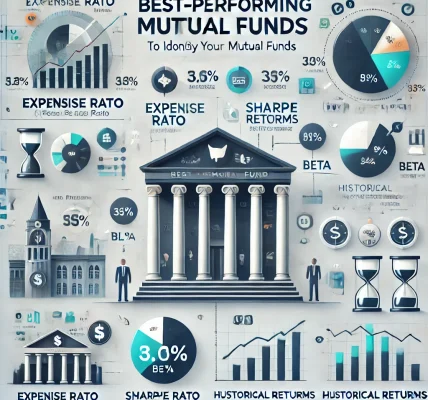

- Higher Fees: Actively managed funds often have higher management fees compared to ETFs, which can eat into long-term returns.

- Less Flexibility: Mutual fund transactions only happen once a day after the market closes, meaning you can’t react to real-time market conditions.

- Capital Gains Taxes: Investors may face capital gains taxes due to the manager’s trades, even if they haven’t sold any of their own shares.

What Are ETFs?

Exchange-traded funds (ETFs) are similar to mutual funds in that they hold a basket of assets, but unlike mutual funds, they are traded on the stock exchange like individual stocks. ETFs can be passively or actively managed, but most are designed to track an index or sector, making them passively managed in nature.

Pros of ETFs:

- Lower Fees: ETFs generally have lower expense ratios because they are mostly passively managed.

- Flexibility: ETFs trade like stocks, meaning you can buy or sell them throughout the trading day at market prices.

- Tax Efficiency: ETFs are generally more tax-efficient than mutual funds because of the “in-kind” creation and redemption process, which minimizes taxable events.

Cons of ETFs:

- Trading Costs: Although ETFs generally have lower fees, you may incur trading commissions or spreads when buying or selling.

- Market Risk: Since ETFs are traded throughout the day, they are more susceptible to short-term market volatility.

- Less Hands-On Management: If you’re looking for professional active management, ETFs may not be the best fit unless you choose an actively managed ETF.

Mutual Funds vs. ETFs: Key Differences

| Feature | Mutual Funds | ETFs |

|---|---|---|

| Management Style | Actively Managed | Mostly Passively Managed |

| Trading Time | Once a day (at NAV) | Throughout the trading day (at market price) |

| Fees | Generally higher | Generally lower |

| Minimum Investment | Often higher | No minimum for most ETFs |

| Tax Efficiency | Less tax-efficient | More tax-efficient |

| Liquidity | Less flexible | Highly liquid, can be traded like stocks |

Which One is Right for You?

- Choose Mutual Funds If:

- You prefer active management and want a professional to make investment decisions.

- You don’t mind paying higher fees for hands-on management.

- You’re investing for long-term goals, and you can reinvest dividends without worrying about taxes.

- Choose ETFs If:

- You want lower fees and better tax efficiency.

- You prefer the flexibility of buying and selling throughout the day.

- You want to track an index or sector without actively managing your investments.

Conclusion

Both mutual funds and ETFs can be valuable additions to your portfolio, but your choice depends on your investment style, goals, and preferences. Mutual funds offer professional management but come with higher fees, while ETFs provide flexibility, lower costs, and better tax efficiency. If you’re looking for a cost-effective way to diversify your investments while minimizing tax impact, ETFs might be the right choice. On the other hand, if you seek active management and are willing to pay for it, mutual funds could suit your needs better.