Top Performing Mutual Funds to Invest in 2025: A Comprehensive Guide for Smart Investors

In 2025, the investment landscape continues to evolve, with mutual funds emerging as one of the most popular choices for individuals looking to grow their wealth. Whether you are a beginner or an experienced investor, choosing the right mutual fund can significantly impact your financial future. This blog aims to provide insights into the top-performing mutual funds that are expected to deliver high returns and strong growth potential in 2025.

Why Invest in Mutual Funds?

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer several advantages, including:

- Diversification: A diversified portfolio helps minimize risk.

- Professional Management: Expert fund managers make investment decisions on behalf of investors.

- Liquidity: Mutual funds are easily redeemable.

- Accessibility: They cater to both small and large investors.

Key Factors to Consider When Choosing Mutual Funds

Before we dive into the top-performing mutual funds for 2025, let’s discuss the key factors you should consider when making an investment choice:

- Risk Tolerance: Different mutual funds carry varying levels of risk. Evaluate your risk appetite and choose funds accordingly.

- Investment Goals: Are you looking for short-term gains or long-term growth? The fund’s objectives should align with your financial goals.

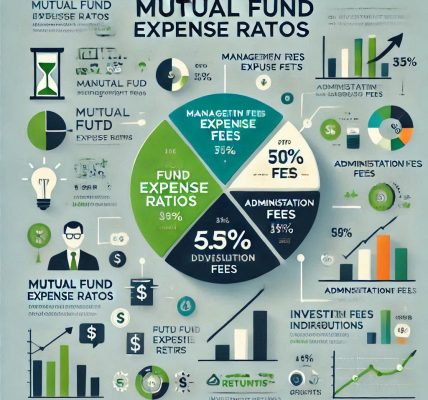

- Expense Ratio: Lower expense ratios are preferred, as they directly impact the returns.

- Past Performance: While past performance doesn’t guarantee future returns, it gives a sense of the fund’s potential.

- Fund Manager’s Expertise: A skilled and experienced fund manager can significantly affect the fund’s performance.

Top Performing Mutual Funds to Invest in 2025

1. HDFC Top 100 Fund

HDFC Top 100 Fund is one of the best-performing equity mutual funds in India. With a long history of generating high returns, this fund primarily invests in large-cap stocks, making it suitable for investors with a moderate risk tolerance.

- Category: Large-Cap Equity Fund

- 1-Year Return: 16.5%

- 3-Year Return: 17.2%

- Expense Ratio: 1.6%

Why Invest: HDFC Top 100 Fund has a consistent track record of performance and strong risk-adjusted returns. With the current market growth, it’s expected to continue outperforming in 2025.

2. SBI Bluechip Fund

The SBI Bluechip Fund is an ideal choice for conservative investors looking for stability and consistent returns. This large-cap fund primarily invests in blue-chip stocks with a focus on growth and income.

- Category: Large-Cap Equity Fund

- 1-Year Return: 18.3%

- 3-Year Return: 14.7%

- Expense Ratio: 1.2%

Why Invest: SBI Bluechip Fund offers exposure to some of the most reliable and high-performing stocks in the Indian market. Its robust portfolio and steady performance make it a strong contender for 2025.

3. Axis Growth Opportunities Fund

Axis Growth Opportunities Fund has made its mark as one of the top mid-cap mutual funds. It invests in emerging businesses with the potential for long-term growth.

- Category: Mid-Cap Equity Fund

- 1-Year Return: 22.8%

- 3-Year Return: 20.5%

- Expense Ratio: 1.5%

Why Invest: For investors with a higher risk tolerance, Axis Growth Opportunities Fund provides the opportunity to capitalize on high-growth mid-cap stocks.

4. ICICI Prudential Bluechip Fund

Another top performer in the large-cap category, ICICI Prudential Bluechip Fund offers a balanced approach to growth and stability. The fund invests in a diversified portfolio of large-cap stocks, ensuring steady returns.

- Category: Large-Cap Equity Fund

- 1-Year Return: 15.1%

- 3-Year Return: 13.9%

- Expense Ratio: 1.0%

Why Invest: This fund is ideal for investors seeking stability in volatile markets while still targeting reasonable growth over the long term.

5. Mirae Asset Emerging Bluechip Fund

Mirae Asset Emerging Bluechip Fund invests in high-growth mid and small-cap stocks, offering a higher risk but potentially greater returns. The fund has delivered impressive returns in recent years.

- Category: Large & Mid-Cap Fund

- 1-Year Return: 20.3%

- 3-Year Return: 18.4%

- Expense Ratio: 1.3%

Why Invest: If you’re aiming for strong growth potential with an appetite for risk, this fund could be an excellent option in 2025.

6. Franklin India Smaller Companies Fund

Focused on small-cap stocks, the Franklin India Smaller Companies Fund offers the highest risk but also the highest potential for returns. These companies are typically in their growth phase, and this fund capitalizes on that potential.

- Category: Small-Cap Equity Fund

- 1-Year Return: 28.7%

- 3-Year Return: 24.1%

- Expense Ratio: 1.8%

Why Invest: If you are looking for aggressive growth and can tolerate volatility, Franklin India Smaller Companies Fund is one of the top choices for 2025.

Conclusion

Choosing the right mutual fund in 2025 depends on your risk tolerance, investment goals, and financial situation. The funds mentioned above are some of the top performers and offer a range of options from large-cap to mid and small-cap investments. Always remember to consult with a financial advisor before making any investment decision, and keep an eye on the market trends to make informed choices.