Investing is an essential step toward financial independence and wealth creation. However, one of the biggest dilemmas investors face is choosing between mutual funds and stocks. Both investment options have their pros and cons, and the right choice depends on your financial goals, risk tolerance, and investment strategy.

In this comprehensive guide, we will compare mutual funds and stocks based on various parameters to help you determine which one aligns better with your investment objectives.

1. Understanding Mutual Funds and Stocks

What are Mutual Funds?

Mutual funds are professionally managed investment vehicles that pool money from multiple investors to buy a diversified portfolio of assets such as stocks, bonds, and other securities. These funds are managed by fund managers, and investors earn returns based on the fund’s overall performance.

Types of Mutual Funds:

- Equity Mutual Funds – Invest mainly in stocks.

- Debt Mutual Funds – Invest in fixed-income securities.

- Hybrid Funds – A mix of equity and debt instruments.

- Index Funds – Track a specific stock market index.

- Sectoral & Thematic Funds – Focus on specific industries or themes.

What are Stocks?

Stocks represent ownership in a company. When you buy shares of a company, you become a part-owner and gain the right to a portion of its profits (dividends) and potential capital appreciation.

Types of Stocks:

- Large-Cap Stocks – Stable, well-established companies.

- Mid-Cap Stocks – Medium-sized, growing companies.

- Small-Cap Stocks – Higher risk, high-growth potential.

- Dividend Stocks – Provide regular income.

- Growth Stocks – Focus on long-term capital appreciation.

2. Key Differences Between Mutual Funds and Stocks

| Feature | Mutual Funds | Stocks |

|---|---|---|

| Management | Managed by professionals | Self-managed by investor |

| Risk Level | Lower (diversified portfolio) | Higher (depends on stock selection) |

| Investment Control | Limited control | Full control over buying/selling |

| Returns | Moderately high (varies by fund type) | Potentially very high but volatile |

| Diversification | In-built diversification | No automatic diversification (investor must diversify manually) |

| Time Required | Minimal effort (managed by experts) | Requires research, monitoring, and active management |

| Costs | Fund management fees (expense ratio) | Brokerage fees and transaction costs |

| Taxation | Capital gains tax applies (depends on holding period) | Capital gains tax applies (based on holding period) |

3. Factors to Consider When Choosing Between Mutual Funds and Stocks

1. Risk Tolerance

- If you have a high-risk tolerance, direct stock investments might be suitable as they offer high potential returns.

- If you are risk-averse, mutual funds provide a safer approach by offering diversification and professional management.

2. Investment Knowledge and Time Commitment

- Stocks require market knowledge, stock analysis, and continuous monitoring.

- Mutual funds are managed by professionals, so they require minimal effort from investors.

3. Expected Returns

- Stocks can provide higher returns if the right stocks are chosen, but they come with higher volatility.

- Mutual funds offer stable returns over time due to diversification but may not match the best-performing stocks.

4. Diversification Needs

- Mutual funds automatically provide diversification by investing in multiple securities.

- Stocks require individual diversification efforts, which can be time-consuming and expensive.

5. Liquidity

- Both mutual funds and stocks offer liquidity, but stocks can be instantly sold on trading days, whereas mutual fund redemptions take 1-3 business days to process.

6. Costs and Fees

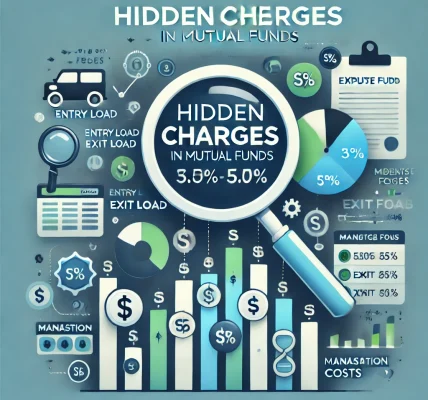

- Mutual funds have an expense ratio, which is a fee paid for fund management.

- Stock trading incurs brokerage charges, transaction fees, and capital gains tax.

7. Tax Implications

- Equity Mutual Funds: Gains up to ₹1 lakh per year are tax-free; beyond that, 10% LTCG tax applies.

- Stocks: Taxation rules are similar; short-term gains (holding <1 year) are taxed at 15%, and long-term gains (>1 year) above ₹1 lakh are taxed at 10%.

4. Which One is Better for Your Investment Goals?

If You Are a Beginner

Mutual Funds are the best option since they are managed by experts and offer diversification. SIP (Systematic Investment Plan) in mutual funds allows disciplined investing.

If You Have High-Risk Appetite and Market Knowledge

Stocks can provide higher returns, but they require thorough research and monitoring.

If You Want Long-Term Wealth Creation

Both stocks and mutual funds can help in wealth creation. However, investing in a mix of large-cap stocks and diversified mutual funds is often a balanced approach.

If You Want Passive Investment with Professional Management

Mutual Funds are ideal as they are managed by professionals and require minimal effort from the investor.

If You Want Quick Gains and Active Trading

Stocks allow for quick buying and selling, but they require market expertise and a higher risk appetite.

5. Can You Invest in Both?

Yes! Many investors combine mutual funds and stocks to balance risk and rewards.

- Allocate 70% to mutual funds for stable, diversified growth.

- Invest 30% in direct stocks for potential high returns.

- Adjust based on your risk appetite and financial goals.

Final Thoughts: Making the Right Choice

There is no one-size-fits-all answer when it comes to choosing between mutual funds and stocks. Your decision should be based on:

- Risk tolerance

- Investment knowledge

- Financial goals

- Time commitment

If you prefer a low-risk, passive investment, mutual funds are a great choice. If you are willing to take risks and actively manage your portfolio, stocks might be the right fit.

Key Takeaways:

- Mutual funds offer diversification, professional management, and stability.

- Stocks provide higher returns but require active research and risk-taking.

- A combination of both can help balance risk and reward.

Always consult a financial advisor before making investment decisions to ensure they align with your personal financial situation.