When deciding between government bonds and corporate bonds, the best choice depends on your financial goals, risk tolerance, and investment timeline. Here’s a breakdown to help you make an informed decision:

✅ Government Bonds

What Are They?

Debt securities issued by a government to fund public expenditures (e.g., U.S. Treasury bonds, municipal bonds).

Pros:

- Lower Risk: Backed by the government, making them one of the safest investments.

- Predictable Returns: Fixed interest payments (coupons) and principal repayment at maturity.

- Tax Benefits: Municipal bonds may offer tax-free interest at the federal (and sometimes state) level.

Cons:

- Lower Yield: Generally offer lower returns compared to corporate bonds.

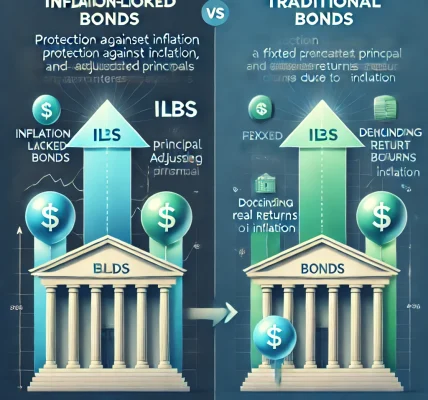

- Inflation Risk: Fixed payments may lose value over time due to inflation.

- Interest Rate Sensitivity: Bond prices fall when interest rates rise.

Best For:

- Risk-averse investors seeking capital preservation.

- Retirees looking for steady, predictable income.

- Diversifying a portfolio with low-risk assets.

✅ Corporate Bonds

What Are They?

Debt securities issued by companies to raise capital for operations, growth, or acquisitions.

Pros:

- Higher Yields: Typically offer higher interest rates than government bonds.

- Variety: Different industries, maturities, and credit ratings to choose from.

- Income Generation: Ideal for investors seeking regular income.

Cons:

- Credit Risk: Risk of default if the company faces financial trouble.

- Market Volatility: More sensitive to economic conditions and corporate performance.

- Taxable Income: Interest is generally taxable at the federal and state levels.

Best For:

- Investors seeking higher returns and willing to accept more risk.

- Those comfortable analyzing company creditworthiness.

- Diversifying with different sectors and risk levels.

📊 How to Choose the Right Bond

- If Safety Is Your Priority: Choose government bonds, especially U.S. Treasuries for maximum security.

- If You Want Higher Returns: Consider investment-grade corporate bonds or a mix of corporate and government securities.

- If You Want Tax Benefits: Municipal bonds offer tax-free interest, ideal for high-income investors.

- If You Want to Balance Risk and Return: A combination of government and corporate bonds offers diversification.