Creating a diversified investment portfolio is a cornerstone of successful investing. Diversification helps mitigate risks, enhance returns, and provide stability in volatile markets. However, achieving a well-balanced portfolio requires thoughtful planning and avoiding common pitfalls. In this guide, we’ll explore the dos and don’ts of building a diversified investment portfolio to help you achieve your financial goals effectively.

The Dos of Building a Diversified Portfolio

1. Understand Your Financial Goals

Before building your portfolio, define your objectives. Are you investing for retirement, a child’s education, or wealth creation? Clear goals will guide your asset allocation strategy.

Action Tip: Break your goals into short-term, medium-term, and long-term to align investments accordingly.

2. Spread Your Investments Across Asset Classes

Diversify your portfolio by allocating funds to different asset classes such as stocks, bonds, mutual funds, ETFs, and real estate. Each asset class reacts differently to market changes, balancing your overall risk.

Example: If stocks underperform during a market downturn, bonds can provide stability.

3. Diversify Within Asset Classes

Don’t just stop at asset classes—diversify within them. For example, invest in stocks from different sectors (technology, healthcare, finance) and geographic regions (domestic and international).

Pro Tip: Use low-cost index funds or ETFs for easy diversification within asset classes.

4. Rebalance Your Portfolio Regularly

Market fluctuations can alter your asset allocation over time. Rebalancing helps you realign your portfolio with your original strategy and risk tolerance.

How-To: Review your portfolio annually or semi-annually and adjust allocations as needed.

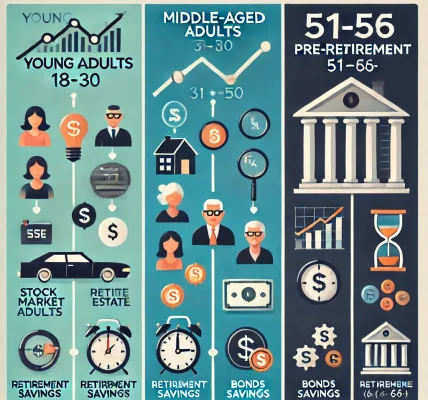

5. Consider Your Risk Tolerance

Assess how much risk you’re willing to take based on your age, financial situation, and investment goals. Younger investors may opt for higher equity exposure, while older investors may prefer safer options like bonds.

Action Step: Use online risk tolerance questionnaires to evaluate your profile.

6. Invest for the Long Term

A diversified portfolio works best over time. Avoid short-term market noise and stay focused on your long-term goals.

Example: Historical data shows that a balanced portfolio typically delivers steady returns over decades.

The Don’ts of Building a Diversified Portfolio

1. Don’t Put All Your Eggs in One Basket

Avoid concentrating too much in a single stock, sector, or asset class. Overexposure can lead to significant losses if that area underperforms.

Example: Investing heavily in tech stocks during a downturn in the sector can impact your portfolio negatively.

2. Don’t Chase High Returns Blindly

High returns often come with high risks. Avoid investments promising unrealistically high returns without proper due diligence.

Warning: Scams often target investors looking for quick gains. Be cautious and research thoroughly.

3. Don’t Ignore Fees and Expenses

Investment fees can eat into your returns over time. Choose low-cost funds and brokers to maximize your earnings.

Pro Tip: Compare expense ratios when selecting mutual funds or ETFs.

4. Don’t Neglect Emergency Savings

Before diving into investments, ensure you have an emergency fund equivalent to 3-6 months’ expenses. This protects you from having to liquidate investments during emergencies.

Advice: Keep your emergency fund in a liquid and safe option like a savings account or money market fund.

5. Don’t Make Emotional Decisions

Market volatility can lead to fear-driven or greed-driven decisions. Avoid making impulsive changes to your portfolio based on short-term market movements.

Tip: Stick to your investment plan and review performance periodically.

6. Don’t Forget Tax Implications

Taxes can significantly impact your returns. Understand the tax implications of your investments and explore tax-saving options.

Example: Long-term capital gains often have lower tax rates than short-term gains.

Final Thoughts

Building a diversified investment portfolio is a strategic process that requires careful planning, regular monitoring, and discipline. By following these dos and don’ts, you can create a balanced portfolio that aligns with your financial goals and risk tolerance while navigating market uncertainties with confidence.