Budgeting is a crucial part of managing personal finances. It helps you track where your money goes, avoid unnecessary debt, and work toward financial goals. One of the most popular budgeting methods is the 50/30/20 rule, which simplifies the budgeting process while ensuring you allocate your income wisely. But is it the right budgeting method for you? In this comprehensive guide, we’ll explore how the 50/30/20 rule works, its benefits and limitations, and whether it aligns with your financial situation.

What Is the 50/30/20 Budgeting Rule?

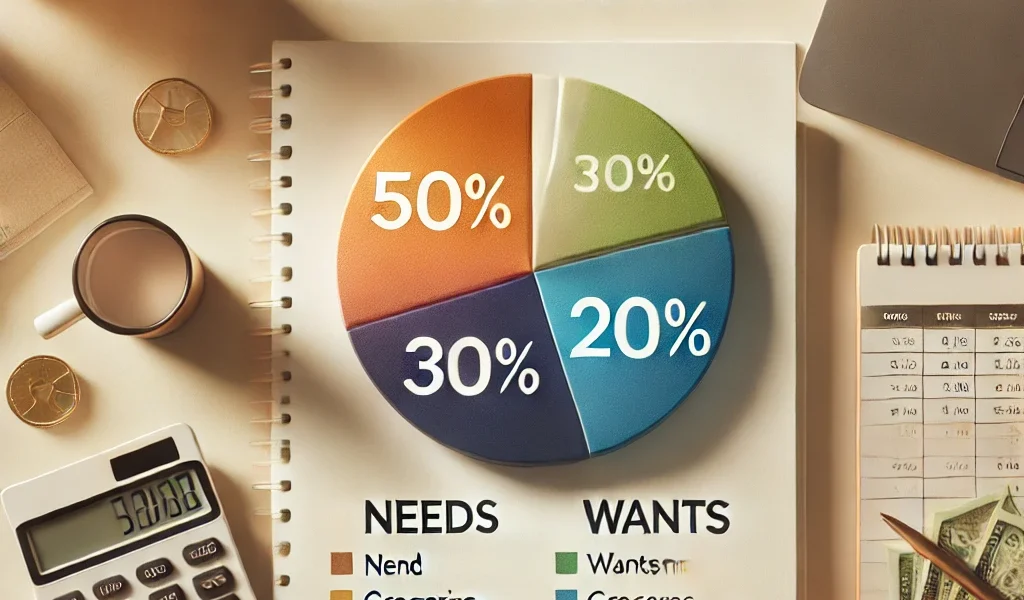

The 50/30/20 rule is a straightforward budgeting framework that divides your after-tax income into three categories:

- 50% for Needs: Essential living expenses such as housing, utilities, groceries, and healthcare.

- 30% for Wants: Non-essential expenses like entertainment, dining out, vacations, and hobbies.

- 20% for Savings and Debt Repayment: Savings for emergencies, retirement contributions, or paying down debt.

This method was popularized by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book “All Your Worth: The Ultimate Lifetime Money Plan.” It provides a balanced approach to spending, saving, and planning for the future.

How to Apply the 50/30/20 Rule

- Calculate Your After-Tax Income

- Include all sources of income (salary, freelance work, side hustles) after deducting taxes.

- If you’re self-employed, account for business expenses and set aside tax payments.

- Break Down Your Spending

- Needs (50%): Rent or mortgage, utilities, insurance, groceries, transportation, and minimum debt payments.

- Wants (30%): Entertainment, shopping, dining out, gym memberships, subscriptions.

- Savings and Debt (20%): Emergency fund, retirement savings, and additional debt payments.

- Monitor and Adjust

- Use budgeting apps like Mint, YNAB (You Need a Budget), or Personal Capital to track spending.

- Review your budget monthly to ensure you stay within the recommended percentages.

Pros of the 50/30/20 Budgeting Rule

- Simple and Easy to Follow:

- Clear categories make budgeting straightforward, especially for beginners.

- Balanced Financial Approach:

- Allows room for both essentials and leisure while encouraging savings.

- Customizable:

- You can adjust the percentages slightly to match your personal goals.

- Encourages Consistent Saving:

- Ensures that 20% of your income goes toward future financial security.

Cons of the 50/30/20 Budgeting Rule

- May Not Fit Every Income Level:

- High earners might find the “wants” category too generous.

- Low-income individuals may struggle to keep essential expenses within 50%.

- Over-Simplified Categories:

- Some expenses (e.g., childcare or medical bills) may blur the lines between needs and wants.

- Not Ideal for Aggressive Savings Goals:

- If you’re saving for a house, early retirement, or other major goals, 20% may not be enough.

Is the 50/30/20 Rule Right for You?

The effectiveness of this budgeting method depends on your personal circumstances. Consider the following factors:

- Your Income Level

- If your income is limited, fixed expenses may exceed 50% of your after-tax income.

- Higher earners may find the 30% wants category unnecessary and may prefer to save more aggressively.

- Financial Goals

- If you’re saving for short-term goals (like a vacation) or long-term ones (like retirement), you may need to modify the savings percentage.

- Lifestyle Preferences

- If you prioritize experiences or hobbies, the 30% wants category allows flexibility without guilt.

Alternatives to the 50/30/20 Rule

If the 50/30/20 rule does not align with your needs, consider these alternatives:

- Zero-Based Budgeting:

- Assign every dollar a purpose so that your income minus expenses equals zero.

- 80/20 Budget:

- Save 20% and use 80% for all other expenses—a simpler alternative for those with irregular incomes.

- Reverse Budgeting:

- Prioritize savings first and spend what remains.

- Envelope System:

- Allocate cash to spending categories to control discretionary expenses.

How to Adapt the 50/30/20 Rule to Your Situation

If you like the structure but need more flexibility, customize the rule:

- 60/20/20 Rule: For high-cost living areas where essential expenses are higher.

- 40/30/30 Rule: For those focused on aggressive debt repayment or early retirement.

Example: If your monthly take-home income is $5,000:

- Needs (50%): $2,500 (Rent, utilities, insurance)

- Wants (30%): $1,500 (Entertainment, hobbies)

- Savings/Debt (20%): $1,000 (Retirement, emergency fund)

Tips to Succeed with the 50/30/20 Rule

- Track Every Expense: Regularly monitor and categorize spending to stay on target.

- Automate Savings: Set up automatic transfers to savings and investment accounts.

- Review Periodically: Adjust your budget as your income and expenses change.

- Prioritize High-Interest Debt: Use part of the 20% to pay down expensive debts first.

Final Thoughts

The 50/30/20 rule is an excellent starting point for managing your money. It provides a balanced approach to spending, saving, and financial planning. However, it’s essential to recognize that no single budgeting method fits everyone perfectly.

By understanding your financial situation and adapting the rule when necessary, you can take control of your finances and work toward long-term financial security.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial professional before making major financial decisions.