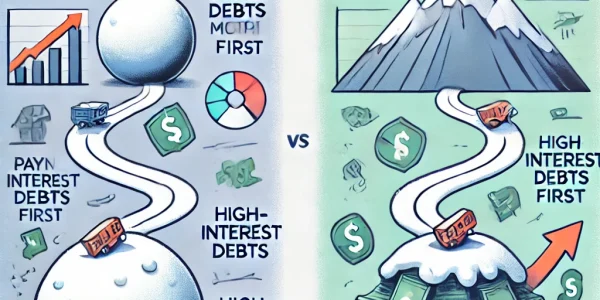

Debt Repayment Strategies: Snowball vs. Avalanche Method Explained

Managing debt can be overwhelming, but having a structured repayment strategy can help you regain financial control and achieve financial freedom. Two of the most popular methods for debt repayment are the Snowball Method and the Avalanche Method. Both approaches…

Index Funds vs. Actively Managed Mutual Funds: Which is Right for You?

Introduction When investing in mutual funds, one of the biggest decisions investors face is whether to choose index funds or actively managed mutual funds. Both options offer unique benefits and risks, and selecting the right one depends on your investment…

Smart Budgeting Strategies for First-Time Investors

Entering the world of investing can be both exciting and overwhelming. As a first-time investor, one of the most crucial skills to master is budgeting. Smart budgeting not only helps you allocate funds efficiently but also ensures that you meet…

The Best Ways to Improve Your Credit Score Fast

Your credit score plays a crucial role in your financial health. A high credit score can help you secure better loan rates, get approved for credit cards, and even affect job and rental applications. If your score isn’t where you…

The Impact of Market Volatility on Mutual Fund Investments

Introduction Market volatility is an inevitable part of investing. Whether driven by economic factors, geopolitical events, or investor sentiment, volatility can significantly impact mutual fund investments. Understanding how market fluctuations affect your portfolio is crucial for making informed decisions and…

Understanding Expense Ratio in Mutual Funds: How It Affects Your Returns

Introduction When investing in mutual funds, most investors focus on returns, risk, and past performance. However, an often-overlooked factor that significantly affects your returns is the expense ratio. This cost can make a substantial difference in your overall profits over…

Estate Planning: Why You Need a Will and How to Get Started

Estate planning is a crucial aspect of financial management that ensures your assets are distributed according to your wishes after your passing. Many people overlook the importance of having a will, assuming it’s only for the wealthy or elderly. However,…

Mutual Funds vs. Fixed Deposits: Which Is a Better Investment?

Introduction When it comes to investing, people often find themselves choosing between Mutual Funds and Fixed Deposits (FDs). Both investment options serve different financial goals, risk appetites, and return expectations. While Fixed Deposits offer safety and guaranteed returns, Mutual Funds…

Tax-Saving Mutual Funds: Everything You Need to Know About ELSS

Introduction Tax planning is an essential part of financial management. One of the best ways to save taxes while building wealth is by investing in Equity-Linked Savings Scheme (ELSS) mutual funds. These funds not only offer tax benefits under Section…

A Beginner’s Guide to Mutual Fund SIPs (Systematic Investment Plans)

Introduction Investing can be overwhelming, especially for beginners who are unfamiliar with market risks and financial jargon. This is where Systematic Investment Plans (SIPs) come into play, making mutual fund investments simple, disciplined, and accessible for everyone. SIPs are a…