Hidden Expenses That Can Derail Your Investment Budget

When planning your investment budget, most people focus on obvious costs such as purchasing assets, transaction fees, and maintenance costs. However, hidden expenses can quietly eat into your returns and destabilize your financial plans. Ignoring these costs can lead to…

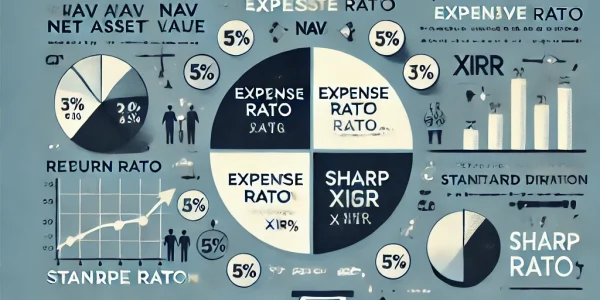

How to Analyze Mutual Fund Performance: Key Metrics Explained

Investing in mutual funds is a great way to build wealth, but simply investing isn’t enough—you need to track and analyze their performance regularly. Understanding key metrics helps investors make informed decisions and ensure their investments align with their financial…

Top Mutual Fund Myths Debunked: What Investors Need to Know

Mutual funds have long been one of the most popular investment options for individuals looking to grow their wealth. However, despite their widespread adoption, many investors still believe in various myths and misconceptions about mutual funds that prevent them from…

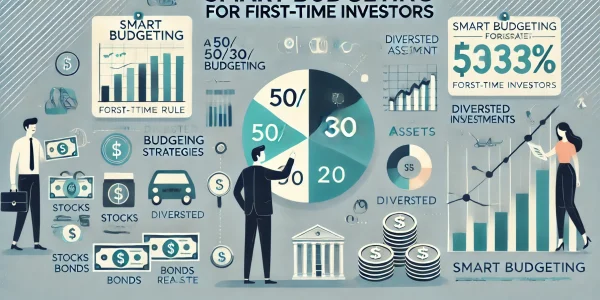

The 50/30/20 Rule: How to Adapt It for Long-Term Investments

The 50/30/20 rule is a popular budgeting strategy that simplifies managing personal finances. It recommends allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. While this rule is effective for everyday budgeting,…

SIP vs. Lump Sum Investment: Which Strategy Works Best in Mutual Funds?

Investing in mutual funds is one of the best ways to build wealth over time. However, investors often face a dilemma when deciding between two popular investment methods: Systematic Investment Plan (SIP) and Lump Sum Investment. Each strategy has its…

Mutual Funds vs. Stocks: Which One is Better for Your Investment Goals?

Investing is an essential step toward financial independence and wealth creation. However, one of the biggest dilemmas investors face is choosing between mutual funds and stocks. Both investment options have their pros and cons, and the right choice depends on…

Smart Budgeting Strategies for First-Time Investors

Investing for the first time can be both exciting and overwhelming. With the right budgeting strategies, first-time investors can effectively manage their finances, mitigate risks, and optimize returns. This comprehensive guide outlines smart budgeting practices to help new investors make…

How to Choose the Right Mutual Fund: A Beginner’s Checklist

Choose a reliable and SEBI-registered platform to ensure secure transactions. Final Thoughts: Making an Informed Decision Selecting the right mutual fund requires thorough research and a clear understanding of your financial goals, risk appetite, and investment horizon. By following this…

Best Investment Apps in [Current Year]: Features, Pros & Cons

Investing has become more accessible than ever, thanks to the rise of investment apps. These apps offer a seamless way to invest in stocks, mutual funds, ETFs, cryptocurrencies, and other financial instruments. Whether you are a beginner or a seasoned…

How to Identify High-Value Stocks Before They Boom: Expert Investment Tips

Investing in stocks is one of the best ways to build wealth over time. However, the challenge lies in identifying high-value stocks before they experience a massive surge in price. Smart investors use a combination of financial analysis, market trends,…