Top Tax Planning Strategies to Save More Money Legally

Tax planning is a crucial aspect of financial management that helps individuals and businesses minimize their tax liabilities while staying compliant with legal regulations. By implementing effective tax strategies, you can optimize your savings, maximize deductions, and ensure financial growth….

Investment Platforms with the Best Mobile Experience

Introduction The investment landscape has evolved dramatically with the rise of mobile technology. Today, investors expect seamless, efficient, and feature-rich mobile platforms that allow them to manage portfolios, execute trades, and analyze financial data on the go. Investment platforms with…

Passive Income Investments: Best Strategies for Long-Term Wealth Growth

Passive income is one of the most effective ways to build long-term wealth. Unlike active income, which requires continuous effort, passive income allows you to generate earnings with minimal ongoing work. By making smart investment choices, you can secure financial…

International Bonds: Opportunities and Risks in Global Markets

Investing in international bonds can be an attractive option for investors looking to diversify their portfolios and access global markets. With opportunities for higher yields, currency diversification, and exposure to growing economies, international bonds can play a crucial role in…

AI-Powered Investment Platforms: Are They Worth It?

Artificial Intelligence (AI) is transforming various industries, and the world of investing is no exception. AI-powered investment platforms have emerged as a game-changer, offering automated portfolio management, predictive analytics, and data-driven insights. But are these platforms truly worth it for…

Cryptocurrency Regulations: How Governments Are Shaping the Future of Digital Assets

Introduction Cryptocurrencies have rapidly evolved from niche digital assets to mainstream financial instruments. With this growth, governments worldwide have been working to regulate the cryptocurrency market to ensure security, transparency, and economic stability. However, regulatory approaches vary widely, ranging from…

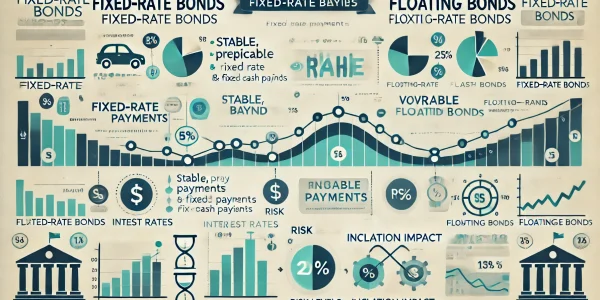

Fixed vs. Floating Rate Bonds: Which Is Better for Your Portfolio?

When it comes to bond investments, understanding the difference between fixed-rate bonds and floating-rate bonds is essential. Both types of bonds can play a crucial role in a well-balanced investment portfolio, offering unique advantages and risks. The right choice depends…

Cryptocurrency vs. Traditional Investments: Which is the Better Bet for the Future?

Introduction Investing has evolved significantly over the past few decades, with cryptocurrencies emerging as a major alternative to traditional investments like stocks, bonds, and real estate. While cryptocurrencies offer high return potential and decentralization, traditional investments provide stability, regulation, and…

Best Retirement Planning Tools for a Secure Future

Planning for retirement is one of the most crucial financial steps you can take to ensure a comfortable and secure future. With increasing life expectancy and rising living costs, having a well-structured retirement plan is essential. Fortunately, there are numerous…

How Secure Are Online Investment Platforms? A Security Breakdown

In the digital age, online investment platforms have become increasingly popular, offering investors the convenience of managing portfolios from anywhere. However, with this convenience comes the risk of cyber threats, fraud, and data breaches. Security is a paramount concern for…