Comparing Robo-Advisors: Which One Suits Your Investment Needs?

Introduction Investing has evolved significantly over the years, and one of the biggest advancements is the rise of robo-advisors. These automated investment platforms use algorithms to manage portfolios based on an investor’s financial goals, risk tolerance, and time horizon. Robo-advisors…

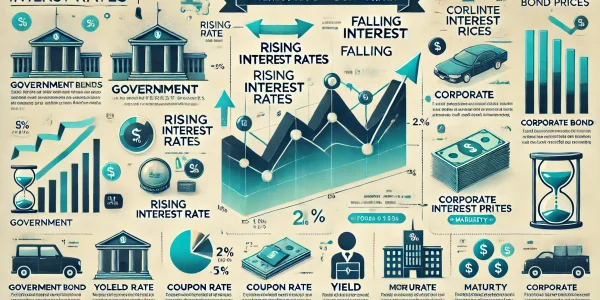

The Impact of Interest Rates on Bond Prices: What Investors Need to Know

Understanding the relationship between interest rates and bond prices is essential for any investor looking to navigate the fixed-income market effectively. Interest rates play a significant role in determining bond yields, prices, and overall investment returns. Whether you’re a seasoned…

Best Wealth Management Services for Retirement Planning – An Honest Review

Introduction Planning for retirement is a critical financial milestone, requiring strategic wealth management services to ensure long-term financial security. With numerous wealth management firms offering tailored retirement solutions, choosing the right service can be overwhelming. This article provides an in-depth…

How BNPL (Buy Now Pay Later) Services Impact Your Credit Score

Introduction Buy Now, Pay Later (BNPL) services have gained significant popularity in recent years, allowing consumers to make purchases and pay for them in installments without using traditional credit cards. Services like Affirm, Afterpay, Klarna, and PayPal’s BNPL option provide…

Best Investment Platforms for Passive Income in 2024

Introduction Generating passive income is a goal for many investors seeking financial stability and long-term wealth. In 2024, investment platforms offer various opportunities, from dividend-paying stocks to real estate crowdfunding, that allow investors to earn money without active involvement. Choosing…

Wealth Management Trends in [Current Year]: What Experts Are Saying

Introduction The world of wealth management is evolving rapidly, driven by advancements in technology, changing investor preferences, and global economic shifts. As we navigate through [Current Year], experts highlight key trends that are shaping the industry. From digital transformation to…

Bond Laddering Strategy: How to Reduce Risk and Maximize Returns

Investing in bonds can provide stability, predictable income, and diversification to your financial portfolio. However, bond investments are not without risks, particularly interest rate fluctuations and reinvestment uncertainty. One effective way to mitigate these risks while maximizing returns is through…

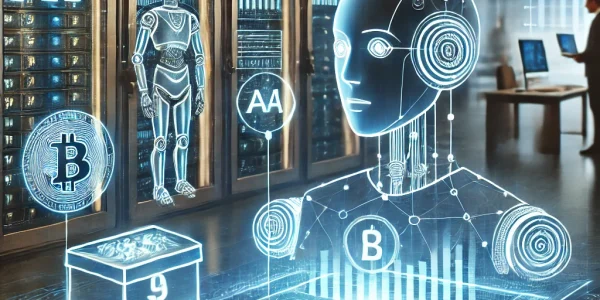

How AI and Technology Are Transforming Wealth Management Services

Introduction The financial industry is undergoing a significant transformation, driven by artificial intelligence (AI) and advanced technology. Wealth management services are no exception, as they embrace digital innovations to enhance decision-making, improve customer experience, and increase efficiency. AI-powered analytics, robo-advisors,…

How to Evaluate Bond Ratings and What They Mean for Investors

Investing in bonds can provide a steady income stream and a relatively lower-risk investment compared to stocks. However, not all bonds are created equal—some carry more risk than others. Bond ratings are crucial tools for investors to assess the creditworthiness…

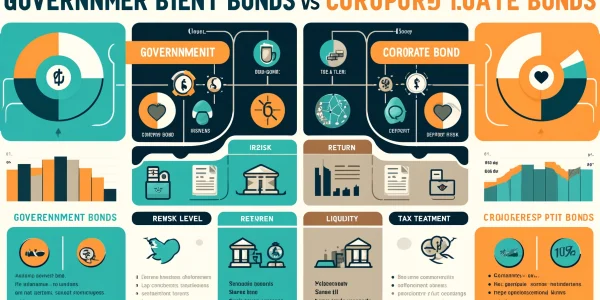

Government Bonds vs. Corporate Bonds: Which One Should You Choose?

Investing in bonds is a popular strategy for individuals seeking stable returns and lower risk compared to equities. Among the many bond options available, government bonds and corporate bonds are the two primary categories. Each comes with its own set…