How to Choose the Right Bond for Your Portfolio

Investing in bonds is a smart way to diversify your portfolio and ensure steady returns. However, with a variety of bond types available, selecting the right one can be challenging. In this guide, we’ll explore the key factors to consider…

The Pros and Cons of Investing in Bonds

Investing in bonds has long been a popular choice for individuals seeking stability and predictable returns. While bonds are often seen as a safer alternative to stocks, they come with their own set of advantages and challenges. This blog will…

Types of Bonds: Government, Corporate, and Municipal Explained

Bonds are debt instruments where investors lend money to an issuer in exchange for periodic interest payments and the repayment of the principal at maturity. Bonds come in various forms, and the type of issuer determines the bond’s classification. 1….

What Are Bonds and How Do They Work?

Investing in bonds is one of the most reliable ways to grow your wealth over time. Bonds are often considered a safer investment option compared to stocks, making them ideal for risk-averse investors or those looking for steady income. In…

How to Read Mutual Fund Fact Sheets: A Beginner’s Guide

Mutual fund fact sheets are valuable tools for investors. They provide a comprehensive overview of a fund’s performance, investment strategy, and risk profile. However, for beginners, understanding these documents can be daunting. This guide will simplify the process, helping you…

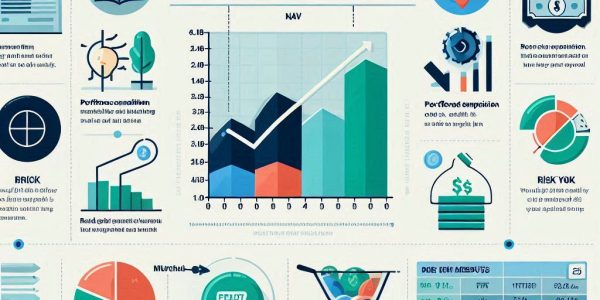

Understanding the Risks and Returns of Mutual Fund Investments

Mutual funds are one of the most popular investment options for individuals seeking to grow their wealth. However, like all investments, mutual funds come with their own set of risks and rewards. A clear understanding of these aspects can help…

The Role of SIP (Systematic Investment Plan) in Wealth Creation

Systematic Investment Plans (SIPs) have revolutionized the way individuals approach investing. By allowing regular, disciplined investments in mutual funds, SIPs have emerged as a powerful tool for wealth creation. In this blog, we’ll explore how SIPs work, their benefits, and…

How to Build a Diversified Mutual Fund Portfolio

Investing in mutual funds is an excellent way to grow your wealth over time. However, achieving consistent returns while minimizing risks requires a well-diversified portfolio. In this blog, we will explore actionable strategies for building a diversified mutual fund portfolio…

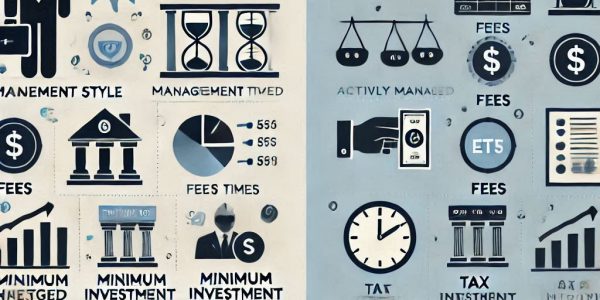

Mutual Funds vs. ETFs: Which One Is Better for Your Portfolio?

Investing in mutual funds and exchange-traded funds (ETFs) is a common way to build wealth over time. Both of these investment vehicles allow individuals to invest in diversified portfolios of stocks, bonds, or other assets. However, they differ in terms…

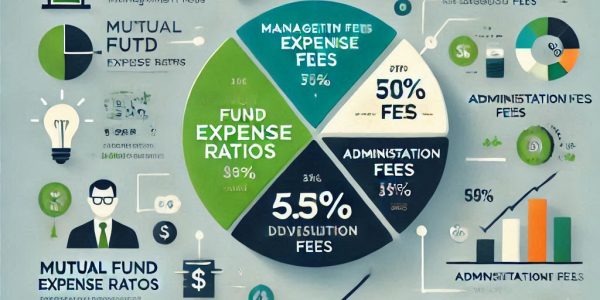

What Are Expense Ratios and How Do They Impact Your Mutual Fund Investment?

In the world of mutual funds, one of the most important factors that often gets overlooked by investors is the expense ratio. But understanding what it is, how it works, and how it impacts your returns can help you make…