The Tax Benefits of Starting a Family Trust

Estate planning is an essential aspect of ensuring your assets are distributed according to your wishes and that your loved ones are taken care of when you’re no longer around. One of the most effective tools in estate planning is…

Understanding Tax Implications of Cryptocurrency Investments

Cryptocurrency has become a popular and potentially lucrative investment option, with many people flocking to digital currencies like Bitcoin, Ethereum, and other altcoins. While these investments have the potential for significant returns, understanding the tax implications of cryptocurrency investments is…

How to Use Depreciation as a Tax-Saving Tool for Businesses

As a business owner, managing expenses and minimizing tax liability is a crucial part of maintaining profitability. One powerful tool that businesses can leverage to reduce taxable income is depreciation. By understanding how depreciation works and how to apply it…

What Is the Alternative Minimum Tax (AMT) and How Does It Affect You?

When it comes to taxes, most people are familiar with the standard way of paying—based on their taxable income, deductions, and credits. However, for some high-income earners or individuals with specific financial situations, there’s a tax system that kicks in…

How to Handle Taxation on Freelance Income and Side Hustles

Freelancing and side hustles have become increasingly popular as more people seek to supplement their income or pursue their passions. However, with this flexibility comes the responsibility of managing your taxes effectively. Navigating the complexities of tax laws related to…

Tax Planning for Newlyweds: How to Combine Finances Efficiently

Getting married is one of the most significant milestones in life. While it brings joy and excitement, it also introduces new financial responsibilities. Newlyweds often need to make adjustments to their financial plans, and tax planning plays a crucial role…

How to Save Taxes Through Public Provident Fund (PPF) Investments

When it comes to tax-saving instruments, the Public Provident Fund (PPF) stands out as one of the most popular and trusted choices among investors in India. Apart from offering attractive returns, it also provides significant tax benefits, making it a…

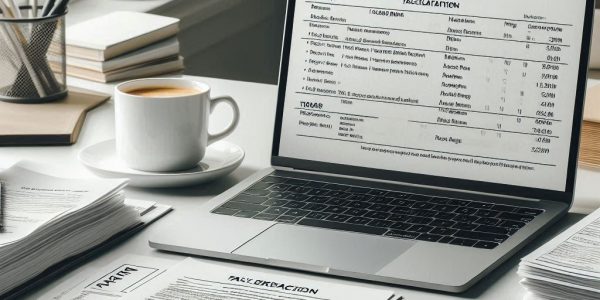

The Role of Tax Planning in Wealth Management

Tax planning is a critical yet often overlooked aspect of wealth management. While investment strategies, asset allocation, and retirement planning typically dominate wealth management discussions, tax efficiency is just as important in helping individuals accumulate, preserve, and grow their wealth…

How to Claim Tax Benefits on Fixed Deposits and Savings Accounts

Fixed deposits (FDs) and savings accounts are some of the most popular investment options for individuals looking to save money while earning interest. In addition to their primary benefit of offering a safe and reliable income, both FDs and savings…

Understanding HRA (House Rent Allowance) Tax Exemptions

House Rent Allowance (HRA) is a common benefit provided by employers to employees to help cover the cost of renting a home. While HRA is a great way to support your housing expenses, it also offers a significant tax-saving opportunity….